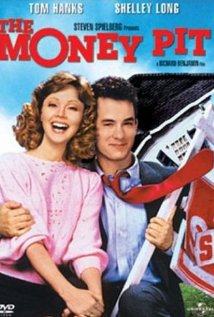

Avoiding the Money Pit

Over the past few posts, we’ve been writing about what we feel are the biggest decisions people are faced with that will allow them to get started on the right foot financially and be able to develop a high savings rate. This is at the core of almost everything else we talk about here when it comes to obtaining financial independence and early retirement. In contrast to other areas (college, cars, debt avoidance, marriage) where we feel that we have done most things right to optimize our situations, when it comes to housing we have made big mistakes. However, we still have done much better than the vast majority of Americans by making one key decision right. Let’s look at that decision first, as it is overwhelmingly the one thing that matters most when purchasing a home. We’ll then look at our mistakes to show you how you could do MUCH better than us in this area if you want to accelerate your path to financial independence and early retirement.

Over the past few posts, we’ve been writing about what we feel are the biggest decisions people are faced with that will allow them to get started on the right foot financially and be able to develop a high savings rate. This is at the core of almost everything else we talk about here when it comes to obtaining financial independence and early retirement. In contrast to other areas (college, cars, debt avoidance, marriage) where we feel that we have done most things right to optimize our situations, when it comes to housing we have made big mistakes. However, we still have done much better than the vast majority of Americans by making one key decision right. Let’s look at that decision first, as it is overwhelmingly the one thing that matters most when purchasing a home. We’ll then look at our mistakes to show you how you could do MUCH better than us in this area if you want to accelerate your path to financial independence and early retirement.

When we were looking to buy our first home, we were making about $70,000 combined, with $0 debt and about $10,000 saved for a down payment. As I recall we were approved for a mortgage in the range of $350K to $400K. Since the crash of the economy in 2008 which occurred around the mortgage crisis, we’ve heard that lending standards are much more strict. I wanted to check if our example was relevant. I went to the Zillow Affordability Calculator to see what the recommended “affordable” house would cost. Entering these parameters ($70k income, $0 debt and $10k down payment) our “affordable” house would be $320,371 This is slightly less than what we were approved for in the pre- 2008 insanity. We bought our first house for $140,000 or about 44% of what we could “afford” in today’s more “reasonable” standards.

By the time we built our current home, we had entered our peak earning years and doubled our total household income to about $150,000. We still had $0 debt. We lived in a tiny apartment ($300/month) for a few years between the two houses we owned and banked my whole salary to save for a down payment of around $100,000. Entering these parameters into the calculator we could “afford” a house costing $794,606. The total cost for land and construction for our home was about $250,000. We built our current home for 31% of what we could “afford”.

It is that simple. By purchasing/building our homes for much less than 50% of what is widely accepted as “affordable”, we have been able to save between $1,000 and $3,500 EVERY MONTH just in the savings on mortgage, interest, PMI and property taxes. Let that soak in for a minute. That is between $12,000 and $42,000 every year. Remember, that is only the savings on the mortgage payment and taxes, if payed for the full 30 years. That does not consider that we were able to save most of the interest by being able to pay our home off quickly. It also does not consider that more expensive houses tend to be bigger, meaning higher utility costs and more time, effort and money to maintain. More expensive houses also tend to come with other expenses such as home owner’s association fees and pressures to keep up to the Jones’ next door. Therefore the $12,000-$42,000/year figure is extremely conservative!

We as a country have been sold on the idea that the American Dream is home ownership. The bigger the home the better! In just the past 40 years, the average American home size has nearly doubled as we pursue this American dream. This is reinforced by a tax system that incentivizes owning homes paid for with mortgages via mortgage deduction in the tax code.

There are many similar “Affordability Calculators” on the internet which will give you similar results. Check them for yourself. Almost all are found on the sites of realtors (who are paid by commission based on sale price) and banks/mortgage companies (who make money based on the interest paid). Politicians then go along with the influence of these powerful industries to provide the tax code which reinforces the realtor and bank positions. After all, why wouldn’t the government want to keep a system going that ties Americans to stay wage earners for 30 years, paying high taxes on their income the whole time while also paying the property taxes that are related to the cost of their homes? This is not a conspiracy theory. It is just a quick overview of the economics of why there is such overwhelming acceptance that these are the amounts that we can “afford” to pay for our homes.

So if we did this well with our housing costs compared to the average American, where did we make mistakes that you can avoid to do better than us? We’ll look at that next week. Until then figure out what percentage of your spending is put toward housing. Figure what percentage you spend compared to what is “affordable” using an online calculator. Think about what you are getting in terms of happiness and satisfaction from life for this amount of money. Ask yourself why you have made these decisions. Do you view your house as an investment? (One of our favorite bloggers Jim Collins may make you rethink that.) Could your money be better utilized in other ways? Give these issues some serious thought and then look back at the $12,000-$42,000 that we have saved annually compared to “affordable” housing and see if your life couldn’t look much different by making one decision differently. Then, come back next week and see how you could do even much better than us.

*Thanks for reading. If you enjoyed this content, you can find my current writing at Can I Retire Yet?. Enter your email below to join our mailing list and be alerted when new content is published.

I calculated about 28% of total net pay is going to renting our apartment. Heat and water are included in the deal. In my area you must pay a higher portion due to the proximity to the big city aka COL is high. Furthermore I do not view a house as an investment because it is a cash drain on you every month. Until you pay it off or realize a profit from a sale, then it is an investment.

I would definitely agree that a house is not an investment. That is not to say that home ownership is all bad. Your house value should more or less keep up with inflation, while the mortgage gives you a constant cost on housing that won’t increase as long as you keep it. A renter is subject to increasing rents and is at the will of the landlord and inflation. When you have the house paid off, you can eliminate this expense completely.

I think it is good to look at the percentage of your income that you spend on each expense to get an idea of where your money is going. However, we don’t worry too much about shooting for a particular percent for each expense. Instead, we focus more on keeping overall expenses as low as possible while leading the lifestyle that we want. For example if you are spending 20% on housing when making $50,000/year and you are happy why double this expense if you increase your earning to $100,000/yr just because you can? That is kind of the point I was trying to make in the post. The calculators will tell you that you can “afford” a certain house based on a percent of your income and many people blindly buy as much as they can afford. We think what you can afford is irrelevant if you can be happy with a house that costs 50%, 25% or even 10% of that.