The First Month Of Early Retirement

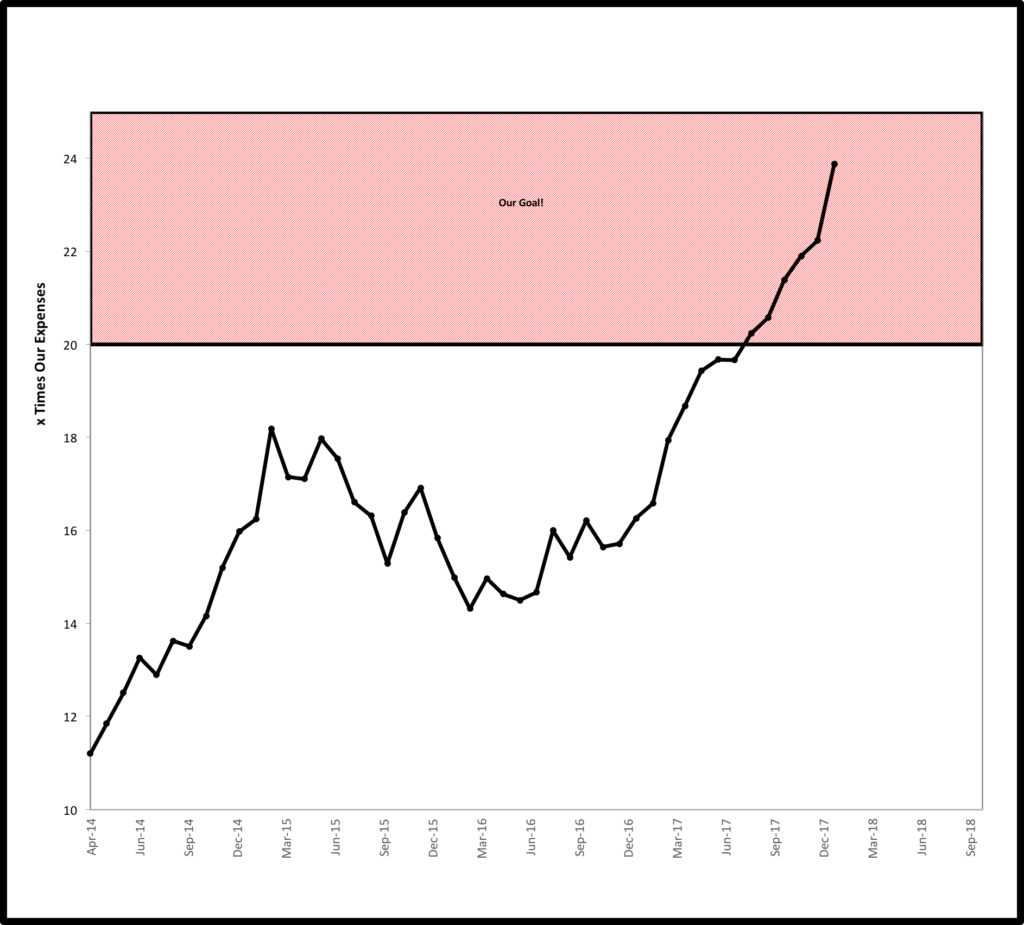

Before we get to the title of this article, let’s dive into the numbers and take a look at where we are as we start into this next phase of life. The graph continues to look very impressive with asset values reaching 23.9x our annual spending. Admittedly, part of this is due to an out of control market that continues to stay at scary high levels.

Before we get to the title of this article, let’s dive into the numbers and take a look at where we are as we start into this next phase of life. The graph continues to look very impressive with asset values reaching 23.9x our annual spending. Admittedly, part of this is due to an out of control market that continues to stay at scary high levels.

However, much of our success is under our control and predictable. We took full advantage of our final year of having a two income household. We maxed out two 401(k) accounts and received full employer matches, two Roth IRA’s, and for the first time ever a Health Savings Account (HSA). We also shoveled the remainder of my pay into taxable investments. Over the past half of the year we also benefitted from additional income (applied to equity in the house) from renting out our future primary residence in Utah.

I wrote a post last January analyzing our spending. At that time, I projected a substantial decrease in our spending in 2017. We saw this play out mostly as predicted.

Our food expenses have continued to decrease as Mrs. EE has really dialed in the grocery shopping. This allowed us to continue to eat a mostly organic, low grain, abundant fresh produce, high protein, and high healthy fat diet at very reasonable cost.

We also benefitted greatly from a successful year of travel hacking. This saved us thousands of dollars on flights, car rentals, and hotels while taking three vacations and several long weekends. We also reduced our investment expenses and tax bill in our first full year of complete freedom from our former investment mistakes.

Despite not saving much on my commuting costs as predicted (I ended up working about six months longer than anticipated) and having higher than usual medical expenses (due to Mrs. EE having finger surgery), we still ended up decreasing our spending by almost $10,000 from 2016 to 2017!

Now about that first month of early retirement…

Lessons From My Last Day of Work

This past February,I told my employer about my plans to retire early. I left work that day relieved to be free of the secrecy I had been carrying around while plotting my plan and blogging about it anonymously for the prior three years. It felt like someone lifted a thousand pound weight off of my shoulders.

That night, in the excitement of the moment, I sat down at my computer and wrote an impromptu post called I Quit My Job Today! It is probably my favorite post I have ever written.

I assumed that my last day of work, Friday December 1st, would be an even better feeling. I assumed I would want to write about it that night, or at least over that first weekend after giving myself a day to celebrate.

Well, I realized that I needed to let everything digest. I needed to decompress. So here I am a month later now that the dust has settled.

I have to say that my last day was much harder than I expected. After working at the same job for 15 years, with largely the same cast of characters for most of that time, it was incredibly bittersweet walking out that door one final time.

I would be lying if I said I wasn’t fighting back tears, and occasionally losing the fight, as I said my final goodbyes, handed out thank you notes, and turned in my keys. I’m a pretty stoic person generally, but I drove the whole way home with tears rolling down my cheeks.

I realized that over the years I shared triumphs and tragedies, weddings and divorces, births and deaths with my “work family”. I spent more of my waking hours over the past 15 years with them than my real family.

On one hand, it is exciting knowing that I am in the rare position of being able to decide where and with whom I want to spend my days going forward at this relatively young age. On the other, there was a sense of genuine loss of the camaraderie that we shared on a daily basis when working together towards common goals.

This will be difficult to replace in this next phase of life. While I can maintain these friendships, they will never be the same as they were. It is something to consider and cherish wherever you are in your retirement planning process.

Money Lessons From the Transition

Leaving my employer opened new opportunities with my investments. I spent a good piece of this first month researching and implementing changes.

Leaving my employer gave me the opportunity to roll over my 401(k) to an IRA. I contributed 5% of my salary to get a 4% match for the first decade of my career. I then maxed out my 401(k) for the past 6 years after realizing the error in passing up the tremendous tax advantages of not doing so earlier. As you can imagine, this plus all of the compounding left me with a pretty hefty balance by the time I left. It represneted about 25% of our investments.

I have written before how both my wife and I were able to influence our employers to make changes to their 401(k) plans, and I am very proud of that. While our input improved each of our plans, neither still are great.

My plan had excellent options for investing in domestic stocks that made up approximately 80% of my 401(k) allocation. It had OK options for holding bonds which made up about 20% of my 401(k) balance. However, the whole plan had administrative fees assessed as a percentage of assets which was nearly .5% annually on top of the expense ratios of the funds.

By rolling over my 401(k) to an IRA I was able to decrease the all in expense ratio of our entire portfolio from a respectable .25% to our current measure of .09%. While these numbers look small on paper, this represents a 64% reduction in our investment expenses, achieved with about an hour of phone calls and paper work.

In real dollars, this means we will save about $2,000 next year, and that number will only grow over time when factoring in compounding. This is an excellent illustration of the massive effects that seemingly small fees have on an investment portfolio.

The other change that I made to our portfolio was enrolling in a HSA. I have been aware of the benefits of these accounts for years, but have never been eligible. To qualify to use a HSA you need to be enrolled in a high deductible health insurance plan. We qualified when we went on my wife’s plan on December 1.

Despite being on her plan for only the last month of the year, we were able to front load our contribution and contribute a full $6,750 in December and will be able to deduct this full amount when filing our 2017 taxes. While the contribution does go up slightly to $6,9000 in 2018, we benefit far more in 2017 as our last dollars are firmly entrenched in the 25% tax bracket. This means we save $1687.50 on our 2017 tax bill.

In 2018, we anticipate our recognized income will keep us comfortably in the 15% (soon to be 12%) tax bracket, meaning the deduction would be far less valuable to us next year. Besides, if we re-enroll in a high deductible plan again next December, we can still do the same thing and make the full $6,900 contribution next December.

This essentially means we get a bonus year of HSA contributions for this one month of enrollment. This is an excellent illustration of the large savings with little to no risk you can get by taking a few minutes to understand the tax code as it applies to your situation.

Finding Freedom in Routine

My biggest focus over the past month has been on settling into a new day-to-day routine. This is something I have been very purposeful about.

I perceive many people’s vision of retirement being never working again, sleeping in late, binging on favorite TV shows, etc. To each their own, but honestly all of that stuff sounds kind of horrible to me.

My individual purpose is to live a more intentional life. I want more time to spend on all aspects of my health (physical, emotional, and spiritual) and with my family, friends, and outdoor hobbies. Simultaneously, I want to continue to challenge myself to grow, learn, and get better every day while continuing to serve others as I did every day of my working career.

I think that within that structure, what I do on a daily basis will change dramatically over time with different seasons of life. Even though I just quit my job, I was very eager to jump into my current routine that contains what a lot of people would consider work. I continue to go to bed early and get up early because our family has settled into a routine that works for us with our young daughter.

However, there is a tremendous sense of freedom in choosing when I work and what I want to work on. For example, one random Wednesday night in December my wife saw that our local ski resort announced their opening day would be the following day.

We decided on the spur of the moment to work early in the morning before getting our daughter up and off to school. Then we got out for first chair, skied for a couple hours, and then came home to finish our day. I could have never done this during my career.

Another indicator of how different our lives already are was the week after Christmas. We planned a week of fun and relaxing with family and friends. My daughter and her friends were off from school and some old friends were in from out of town.

As it played out, my daughter had a little too much Christmas and got sick Christmas night. She then passed her illness on to my wife. All told, we barely left the house for the week.

In my old life, this would have been a cause of massive stress and anxiety. It would have been a tremendous waste to have spent one of our precious few weeks of vacation time sitting around the house sick. We would have likely tried to push through and in the process had a miserable time.

Instead, they were able to rest and recover as they needed. I avoided getting sick and was able to relax and take care of them, knowing that next week and the week after were going to have equal potential to be awesome.

It is an amazing feeling of daily freedom and a change of perspective from the constant grind of having to go to a job day after day while living for weekends and vacations.

A Big Shout Out

I was very happy (for him) and a bit sad (for me) to see that over the holidays J$ announced that he sold the website Rockstar Finance, to focus on his new baby (literally) and his old baby (figuratively), his original blog Budgets are $exy. He also announced that Cait Flanders will be leaving the site to focus on her own site and promote her soon to be released book.

I just wanted to publicly thank both J and Cait for their long standing support of this blog. J featured the ninth post I ever published on this blog, Dirtbag Millionaires. At the time, I had somewhere around 8 consistent readers, more like 3 if you don’t count my family. The free publicity and massive boost in traffic he gave me, when I had absolutely nothing to offer in return, kept me writing when I was close to giving up. This literally changed the course of my life.

Since then, J and Cait have featured my content 10 times despite my very sporadic writing over the years. As important as their public support has been, they have both taken the time to offer private encouragement and support at different times as well. They are both awesome people and I want to publicly thank them and wish them well in their new endeavors.

Rockstar Finance certainly seems to be under good stewardship with ESI Money now at the helm and Steve from Think Save Retire staying on board. Best wishes to these guys as well in continuing to make Rockstar Finance one of the most positive and generally awesome places on the internet.

My Own New Adventures

On January 8th, I will be publishing my first regular post at Can I Retire Yet? From that point forward that will be my new primary home on the web.

I have already been at work behind the scenes. This is an exciting time. Darrow Kirkpatrick and I will begin a regular weekly publishing schedule every Monday.

My role will be to provide content and work on the business and marketing side of the blog. As part of this, you may have noticed that I retired the handle @elephant_eater and changed to @caniretire_yet on Twitter. I’m still trying to figure out how to actually use Twitter effectively as a way of connecting with others and marketing a blog without it becoming a major time suck. If anyone has any insights or tips to share I would love to hear in the comments or a private e-mail.

My role at Can I Retire Yet? will free up more of Darrow’s time for the original research he has become known for over the years while developing the blog into one of the most respected personal finance sites on the internet. He also continues to work on enhancing his two new retirement calculators which he released in December. Click over to read about them and give them a try.

I have also been spending a lot of time doing research for a book that I have been wanting to write for some time. I will share more details on this project at a later time as it comes together.

I continue to toy with what I want to do with this blog going forward. I recently paid to keep the domain for at least another year. My plan for now is to replace the monthly updates we have been doing with quarterly ones.

Otherwise, I will be focusing my time and attention on Can I Retire Yet? and I hope you all will follow me there. If you haven’t already, enter your email in the box below to subscribe.

I hope you all had a great holiday season and best wishes for a prosperous, healthy, and happy new year!

Congratulations and hope all the family are well after the bout of Illness.

I can imagine The emotions of leaving work will also be same for me. Some folks I have known for 25 years as they moved with me from the UK to the US. It’s gonna be difficult for me and I know it.

Look forward to the collaboration stuff at CIRY and seeing how it all develops. The book thingy also sounds fun. Quite the project and I am sure you will through yourself right into it. Best of luck.

Speak soon.

Mr. PIE

Thanks. Everyone starting to come around, finally!

I really didn’t anticipate how emotional that last day would be. Sounds like your situation is very similar, so be prepared.

Thanks for the encouragement. I’m very excited to go down these new roads.

Have a happy new year to you and the PIE crew!

Congrats! One thing to note about the HSA “last month rule” since you seem to be questioning whether you’ll stay on an HSA eligible HDHP is that to be eligible you need to remain on a HDHP plan for the whole next year (through December 31, 2018). See https://apps.irs.gov/app/vita/content/37/37_06_040.jsp?level=basic. So, if you switch plans to a non HSA plan for any of 2018 you’ll no longer be eligible for 2017 under the last month rule, so I suppose you’d need to remove the contribution and file an amended return.

Terran,

You’re absolutely right about the “last month rule”. I didn’t want to go that in depth as just touching on a couple of different topics in one post, but good catch and tip. I believe you actually have to pay a penalty of 10% as well when you w/d the funds, but we were OK with the risk as our intention is to have the high deductible plan going forward.

Gogogogogogogogo!

So glad you have joined the co-hort. I’m a little more than 5 years gainfully unemployed and it just gets better with time. You are going to love your new life.

Thanks my friend. I really appreciate your long-term support! Have a great new year.

I’ve enjoyed reading you this year and look forward to continuing that on Darrow’s blog. I enjoy the insight you bring and your personal style of narrative. Here’s to a great 2018!

Thanks so much for the kind words. I’m happy to have you as a reader. Happy New Year to you as well!

First off, congrats! But wow, your description of your last day at work was compelling. It’s amazing how much our jobs - even if we don’t like them too much - become part of us. Especially the people.

I was hoping to fully prevent those emotional losses by going part time instead of fully getting out. So far I’m 3 months in and results are mixed. I do still go to work 20 hours a week so I still see my longtime colleagues and friends. But now the interactions are weird. They kind of treat me differently, because either they know I’m not “in it for the long haul” and serious about my career, or perhaps they’re jealous. Or a mix, I don’t know.

Either way, there’s no perfect solution and I think we both know that we have to follow where our hearts are pulling us, regardless of the negatives.

Looking forward to your contributions on Darrow’s blog, Happy ’18!

Thank you. You’re right that there are a lot of complex emotions and factors that go into these decisions.Also agree that there is no right or wrong answer when making such life altering decisions. A lot of times you kind of have to follow your gut, which is a hard thing for people like us who pride ourselves so much on being rational, numbers driven math geeks. Have a great new year and best of luck with your blogging efforts.

I had the same sort of day when I retired after 19 years.

Have been very fortunate to invest enough to live on plus the usual

pensions here in Canada.

Thanks for sharing Bob. I wish you ongoing good fortunes into the new year and beyond.

I’m coming up on the two year anniversary of my early retirement and honestly I can barely remember what my stressful corporate life was like. Now I pursue a handful of profitable but also low stress side gigs and a lot of volunteer work as well. I still feel relevant and significant and I don’t miss that former life at all. I honestly thought I might, because I really enjoyed my job most of the time, but in two years I never once thought that I’d like to be back at that again. I am betting you will find that to be the case. Congratulations!

Thank you for the kind words and encouragement Steveark. I am very confident in my decision, but it is always nice to get that little extra feedback from someone who has already done it.

Hey this is Travis, I met you on the train ride home from FinCon17. Congrats on the new move and I wish you much more success. I look forward to reading more of your work over at CIRY. Here’s to FI with kids!

Hey Travis. I remember you well. Thanks for reading and the kind words. I hope all is well for you and yours in ID as well in the New Year.

Life is good, my man 🙂

So true! Happy New Year!

So glad to read your recent article. I am thrilled to read how your “retirement” is going and knowing that you are enjoying the moments in your life without having the financial worries because of great financial planning. Enjoy my friend.

Thanks. Glad to see you’re still reading!

It’s fascinating to see that folks feel very differently than they imagined they would once ER actually takes shape. Congrats on your new ventures and your dedication to continuing to improve yourself and the world.

Agree ZJ. I knew there would be aspects of my job I would miss, but for some reason I did not anticipate the magnitude of my emotions the last week or so, and particularly that last day. I think it really reinforces the idea that we need to be present wherever we are on the journey and enjoy what we have, versus always looking ahead to the next thing. Unfortunately it is much easier to say than do!

Happy new year! It’s interesting how things don’t always seem to feel as planned. I thought I’d get emotional when elaving my last company, but not so much. Like you though, it took about a month before it really “felt real.” Here’s to a great 2018!

Agree, my emotions that last week and particularly that last day threw me a bit. That said by the following Monday, I settled into my new life and I haven’t looked back. While I miss the people on the other side, this side is pretty sweet. 🙂