Why We’re Happy We Didn’t Achieve Our Goal

As 2017 rolls in, many people talk of resolutions and goals for the new year. There is also a lot of reflection on the year that was.

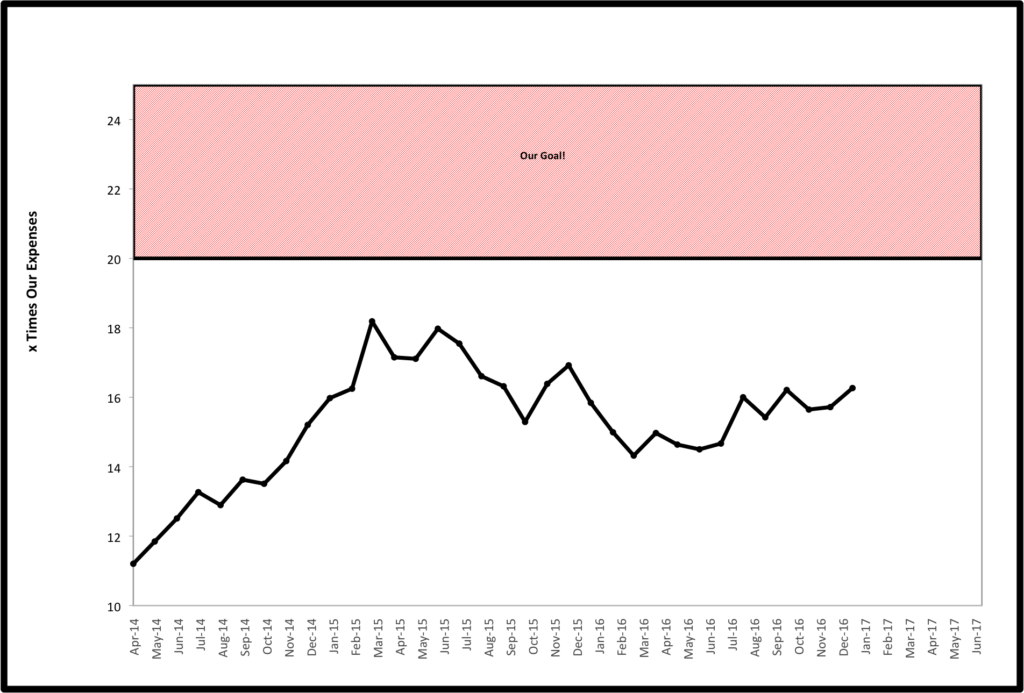

Our primary goal when starting this blog was achieving financial independence and retiring early. We defined this as achieving assets valued at 20-25X our annual spending by May 2017.

We spent the past year saving over 60% of our after tax incomes and experienced good investment performance. This increased our net worth approximately $200,000 over the past 12 months. However, our annual spending also increased in 2016, approximately $10,000 compared to the year before. Factor it all in and we actually took a small step backward with our assets/annual spending dropping from 16.9 at the end of 2015 to 16.3 at the end of 2016.

After reflecting on our numbers, we’ve come to the conclusion…

After reflecting on our numbers, we’ve come to the conclusion…

We’re Happy to Not Reach Our Goal!

Don’t get me wrong, we would love to have abundant wealth and never have to worry about money at all. We certainly will continue to work towards financial independence. We will work toward achieving true financial abundance where we can not only maintain our spending without having to worry about working to earn more money, but increase spending if we choose.

Technically, we are not happy that we have lost ground towards our goal. However, we are much happier right now than we were a year ago at this time. I was having a hard time putting into words why this is until I recently read the following quote:

“Failing to achieve your goal can mean achieving your real goals.”

I recently read the Tony Robbins book “Awaken the Giant Within”. As I was pondering where we currently stand and where we are going, the above quote really resonated with me.

He had another key concept in the book that resonated. The quality of the questions that we ask determines the quality of our life. To expand on that concept, the quality of our goals is dependent on striving for and measuring the correct things.

Confusing Ends and Means

When setting out on the path to FIRE, Mrs EE and I mutually agreed that we crave more time. Time to deepen our faith, develop our relationship, raise our daughter, improve our health, and have time for friends, family, and hobbies. All of these things caused us to seek FIRE, with a goal of hitting a number as quickly as possible.

However, all along FIRE has simply been a means to these ends. As we became focused on hitting a number, we were finding ourselves to be less happy people.

Now that we have learned to differentiate ends and means, we are much more on the same page. This has led us to be happier and more at peace.

Mrs. EE and I are at very different places in our professional lives. We also have very different views on money, based on the family situations in which we were raised. We have talked and worked together long and hard over the past year to reach common ground on what would meet both of our needs and wants. We now realize that these are our “real goals” that will allow us to achieve our ends, even if the means are a bit different than we anticipated when setting our original financial independence day, focused on retiring early.

Our Jobs

I am very burnt out on my job and career. I have been in the same job for about 13 years and everything is stale. FIRE is very appealing to me.

I need a drastic change, but improving my situation by simply changing jobs is highly unlikely. My workplace, like any, has things I wish were different. However, I am compensated well, have great autonomy, take 4-5 weeks of vacation each year, and have built great relationships with clients and referral sources in my community. I would never have that, or would take years rebuilding it, if starting from scratch somewhere else. In fact, I would be hard pressed to find much better working conditions than I have.

In spite of all of that, there are many things that I can not stand about my job/career. These include a general disgust with our fee-for-service healthcare system with grossly misplaced incentives that effectively punishes efficiency and effectiveness, seemingly never ending increase in bureaucracy and paperwork, the infinite need to trade time for money, and work around others’ schedules. These will be present wherever I go in my current career, and could definitely be far worse.

Mrs. EE is in a totally different place. She is incredibly happy in her job. She works from home for a company that is extremely family friendly. She is location independent. She is able to support our family on her part-time income, even while maxing out her 401(k) (which by the way is excellent). Her employer will cover our family on their healthcare plan, even at her part-time status. Her work challenges and stimulates her.

She does not want to quit her job. FI is very appealing to her, early retirement is not at this point in time. The idea of having to retire to stick with our plan actually stressed her out more than work.

Our Money Philosophy

I grew up in a entrepreneurial family. I know what it is to live in a house where things are not predictable financially and have seen it work just fine. I am very optimistic in our ability to be resourceful and flexible as needed.

Mrs. EE grew up in a family where things were often very tight financially and she has seen how hard things can be without a regular income. Though she knows we are resourceful and good with money, she craves the stability and comfort of our current lifestyle.

We both agree that we have no desire to live our lives around a set budget. We have always been very good at living below our means, even when starting out making very little money. However, we also like having the ability to do the things that we want on our terms. This includes being able to travel when and where we want, planning our diet around health and enjoyment rather than budget, and being able to give freely when and where we choose.

Achieving Our True Goals

Our “ultra-safe early retirement plan” (which FYI is very similar to what this recent NY Times article refered to as the “Retire Never Option”) that we have been developing and fine tuning over the past year is working towards achieving our true desired ends. We’ll share what exactly that will look like as things unfold over the first half of the year. For now, I can tell you it means living a truly balanced and fulfilling life filled with love, adventure, security, and abundance starting now, rather than starting when some magical number that tells us that we are FI or on a date when we decide to retire.

Did you reflect on the past year? What goals did you reach (or not reach) in the past year? Are you working towards the right goals or are your goals and plans evolving as you learn and grow? We’d love to discuss it all in the comments below.

*Thanks for reading. If you enjoyed this content, you can find my current writing at Can I Retire Yet?. Enter your email below to join our mailing list and be alerted when new content is published.

What do you do in the healthcare field that you despise so much?

I’m a physical therapist. It is not so much what I do, but the whole system as a whole that turns me off.

Getting more specific to the incentives, I am paid more for providing more care and having patients come for more visits. I get essentially punished for providing better care, getting patients better faster or with less care during each visit.

As for bureaucracy, as a recent example I just renewed my license. I took a course through Selective Functional Movement Assessment (SFMA) which had an online pre-requisite component that was excellent, improved my practice, and took me about 15 hours to complete. However,it gave me exactly zero hours towards my continuing education requirements, b/c this online portion is not approved by my state board. So I bought another online course that gave me 10 hours of credit from a provider that is state approved, that took me less than one hour to complete while being able to complete the exam scoring 100%, taught me essentially nothing and cost almost $200. However, b/c it is approved it allowed me to check the box to get my license.

Such a great write-up to read at the beginning of the year. Thank you! You’ve shared insight that helps me shape goals for 2017. In particular, your candor and openness about being so very focused on “the number” for financial independence as having playing a role in being less happy, well, that’s a great reality-check. My household too has been in a rut, in part and for far to long, for the same: trying and focused too hard to reach financial goals and missing out on spending on both current adventures and comfort-related stuff. Thanks too for the links to the interesting and informative articles.

Thanks for the positive feedback RB. Hope this helps shake you out of the rut by focusing on what is important now rather than putting happiness off until everything is perfect.

For years my goal was FI and when I got there it was then, what next? Just set different goals to challenge yourself and have a purpose. Think even of a different career that you could do from home or hobbies that could be a business.

There are so many great things to do in the world, do them all! Happy New Year to all of you and enjoy life!!

Great to hear from you Ed! I appreciate your insights and advice always.

Happy New Year to you as well.

What a top article. It puts in writing what I feel we are going through.

The last year, we have evolved from reaching a number into living an intentional meaningful life now. FI is way we want to reach that goal, not at any cost.

Maybe the real goal is tocreate a series of habits that combine FI with intentional relationships and living now.

Thanks AT. Sounds like we are very much on the same path, though it is easy to stray from it. Let’s do what we can to keep each other accountable.

Haha, not surprisingly, we’re kind of in the same boat. We both like our jobs, but are sort of lost in that as we’re getting closer to the FI number, it’s not really what we want. I mean, neither of us really wants to “not work forever” but like you said, just have more time. Time to do things we want to do, not just do things as a means to an end, or because you’re in a rut.

Our only 2017 change s to be more present and work on doing more exciting stuff as a family. Everything else, is pretty much auto-pilot at this point, so being more present and enjoying now is pretty much our only goal.

As Mrs. SSC put it, “Let’s work towards being who we envision our FFLC selves as and not wait years from now to try and change that.” I thought, yeah, it’s pretty simple when you put it like that. 🙂

Life seems to be pretty simple in general until we start getting in the way and making it way harder than it needs to be.

Excited to see/hear what you guys do! Have a great 2017.

Can I just say that I want your wife’s job? Or one like it?

This is a great post, and reminds me of a Seth Godin quote often shared by the White Coat Investor: “Instead of wondering where your next vacation is, maybe you should set up a life you don’t need to escape from”

That’s what it’s all about; finding that ideal situation. For me — like you — I think it may not involve healthcare. But the career has been great in that it has put me in a position to have options.

Cheers to not meeting your goals!

-PoF

Ha. I’d like to have her job as well. We were worried about making too much money if having to buy our own healthcare, but since they will cover us with her working p.t., it is a no brainer for her to stay on. Love that quote and agree wholeheartedly with it. Just read WCI’s kind-of anti FIRE post, which I must say I agree with and is in line with our thinking/planning.

I appreciate you writing this up, as most financial blog posts are glorifying the FIRE movement. It is a hard thing to save so much, and a break now and then is well deserved. For myself I don’t think the high saving is limiting my happiness, but the lack of time for myself. There is something to be said for extending the time to true FIRE and picking up a job you deeply enjoy.

Now that being said: Make 2017 YOURS and Hit that GOAL!

Thanks for the feedback Zed. Agree that saving is not limiting my happiness as I truly don’t see it as sacrifice and I think building wealth and seeking FI quickly are great goals/objectives in context. We have struggled in two ways. 1.) Like you, not having time for the things that are truly important to us which gets frustrating. 2.) Getting overly focused on a number causing us stress and anxiety thinking too much about the future, rather than being present and enjoying the journey.

We’ll eventually hit the number goal as we have put the processes in place to make it inevitable. Regardless of where the numbers are, we’ll be beginning our transition over the next few months. Hope you follow on the journey and appreciate your feedback.

“As we became focused on hitting a number, we were finding ourselves to be less happy people.”

A thousand times yes to this! I’ve been experiencing this as well and am trying to reshape my goals towards more happiness

I think this is a common experience that people in the FIRE community don’t talk about very often. Everyone (myself included) sells the positive aspects of FIRE, and there are many. However, the idea of delaying gratification and enjoyment of life for a time of retirement revolving around no work and all enjoyment is flawed in my opinion. There needs to be a balance, and we need to keep focus on what our true goals are while on the path so that money doesn’t become too great of a focus and we don’t forget to enjoy the journey. Glad you could relate and hope you find this helpful.

EE

Congratulations on increasing your net worth by $200,000 in one year and becoming more happy. I think the ultimate goal for most people is true happiness and some believe this will be achieved by FI. I believe FI will help and as the saying goes “Life is a journey not a destination.” Some may not find happiness when they achieve the destination of FI so try to find happiness in the journey to FI.

Thanks for the encouragement. We are still very excited about achieving FI but definitely are enjoying this home stretch now that we are working toward the correct goals.

You bring up many good points. Obsessing too much over the whole FIRE plan probably isnt a healthy way to live. Its good in that you are really working on your plan, but not good if that becomes all consuming on hitting your number and just living for that over years and years. You have to get yourself to enjoy some things now even if it means spending some money to do it. You cant predict what the markets are going to do. Set your investment plan in motion and let it do its thing. Check in on it and maybe make some adjustments occasionally. Thats what worked for me. I set my accounts on automatic and just went to work. Even though I read a lot on finance, I didnt mess with things much. Spending hours and hours of research likely wont give you any real long term edge for all the time you spent. As far as working goes, you guys are still pretty young and I might lean towards sticking it out longer. One thing I did, was to try and get more efficient and caught up at home so that once work was done I could spend more time enjoying myself rather than doing chores etc. It helps in that it keeps work from appearing to cut into more of your personal time. If your wife is doing well and happy with her job, I might try to find a way to keep that going for a while if possible. Good paying jobs and situations are harder to come by these days and sometimes its hard to get back in to something good once you quit.

Arrgo,

You hit the nail on the head about just setting up processes and then letting wealth accumulate. While this blog has been positive in many ways, it has caused us to focus too much on retirement. Before we never payed much attention and I think in many respects it is a healthier way to go about it.