March Update

Trending Upward

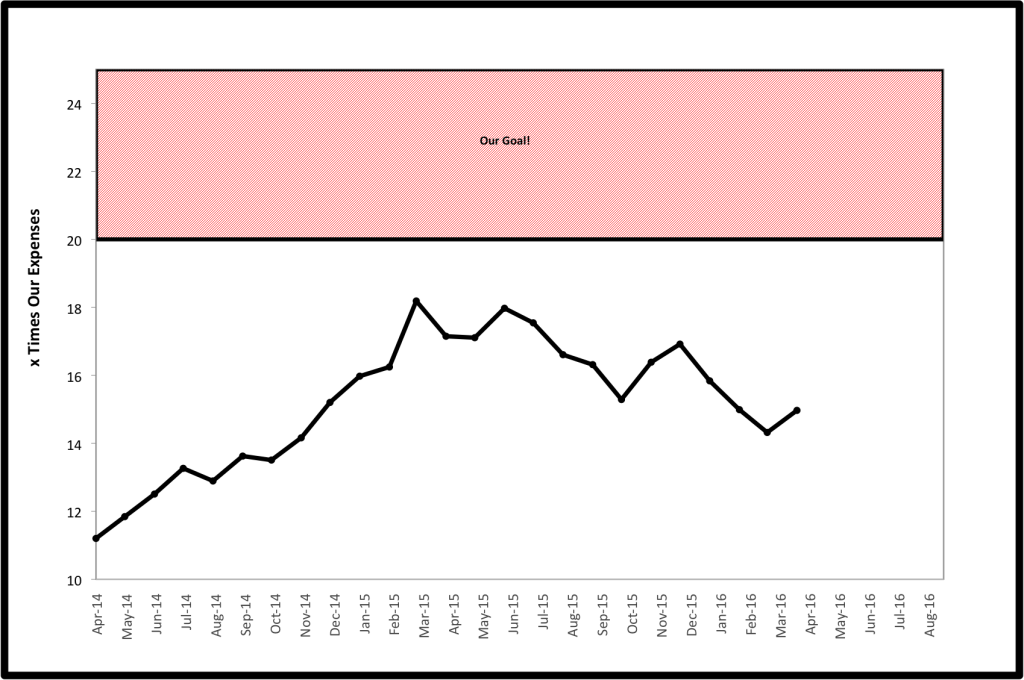

It was a very good month for net worth. Our asset value went up over 7% due to a combination of a strong market rebound, continued regular contributions to our investment accounts and reinvestment of all quarterly dividends that hit our accounts in March. However, our spending was up again, increasing our monthly average spending by $100. Our assets now sit at 15X our annual spending, which is a nice jump from 14.3 last month. However, we’re still a good bit off of our peak of around 18X one year ago despite substantial gains in our investment value from that time.

The Impact of Spending

It is interesting to look at our numbers and consider the impact of even relatively small changes in your spending. This past month, our monthly average spending went up by $100. Factored in over a year, our spending went up $1,200 ($100 X 12 months). Assuming you could safely live off of your portfolio while taking 4% each year, this seemingly small increase in spending means that we would need an extra $30,000 to support that increase indefinitely. This canceled out a big part of our portfolio increase as seen in the chart.

This just goes to show that it is far easier to cut your spending by seemingly small amounts, than to save these seemingly large amounts. For example, many people could save $100 monthly very easily by skipping eating out once or twice, cutting cable, changing phone plans, etc. Conversely, maxing out a 401(k) ($18,000) + a Roth IRA ($5,500) for an entire year would get you only about 80% of the way to saving enough to have an equivalent impact.

Creative Solutions

On the flip side of the coin, there is only so much saving you can do until you begin to feel like you’re sacrificing. Looking at the numbers in this way also makes you realize that it is hard to save your way to complete financial independence. Even if we could save $100,000 (which on our incomes we can’t) by working an extra year, it only allows us only $4,000/year in additional retirement spending. This realization is one of the reasons that we are so committed to our FI date, regardless to where our numbers are at. We are very happy to have the security of being in the neighborhood of FI, knowing we have enough to at least support all of our necessities without having to ever work again. Our goals are more in alignment with the idea of a “Fully Funded Lifestyle Change” as espoused by the blogging couple at Slowly Sipping Coffee.

Like most people in the FIRE community, barring a complete catastrophe, I don’t think we’re ever in danger of running out of money and not being able to support our living expenses. I also don’t think we’ll ever be massively wealthy where we can live anywhere, buy anything, travel in any style, etc without budgetary consideration. We therefore believe that after covering our basics, it will be far easier and more fun to be creative with earning small incomes or being creative with spending in retirement while living with much more freedom compared to continuing lives that revolve around jobs just to save more money.

Let’s look at an example. We love to ski and plan to buy a ski pass every year for the rest of our lives as long as we are healthy enough to be able to use them. We’ll assume a yearly ski pass is $1,000 per person. For two people, this is $2,000/year. To support this expense, we could save an extra $50,000 ($2,000 X 25).

Alternatively, we could plan to each work part-time at a ski resort (ski patrol, rental shop, bartender, etc) to get free passes. Let’s assume we have to work 2 days/week for 5 months/year (mid-Nov to mid-April) to get this benefit. Let’s assume we make $10/hour after taxes. Over those 5 months we would make $320/week, or $1,280/month. After 5 months we would make $6,400. Using this money towards our living expenses would eliminate the need to save an additional $160,000 ($6,400 X 25).

Eliminating the need to save enough to buy our ski passes plus the very small income earned in the process would be the equivalent of saving an extra $210,000 towards a traditional retirement. Would it be better to work full-time for 3 extra years to save this amount, or would it be better to be “retired” for 7 months and then work 2 days a week for the other 5 months to have the same financial impact? I know what the answer is for us.

How about you? Are you more committed to change your lifestyle based on reaching a FI number or a FI date? Are you willing to be creative by earning small amounts of income in early retirement or are you committed to a more “traditional retirement” characterized by not working? Do you have creative ways to decrease your spending to give yourself some leeway? Share your thoughts below.

*Thanks for reading. If you enjoyed this content, you can find my current writing at Can I Retire Yet?. Enter your email below to join our mailing list and be alerted when new content is published.

Top recommendations

For me it’s all about optimization of your money. The near term focus should be to get your expenses to +/- say 5% of your target but after that all the expense reduction improvement will be much harder to get. At that point you focus on side hustles or career changes to boost your income and really juice up your savings rate.

I like the cover your base expenses through investments and then hustle your way for the fun money. I hadn’t really thought about it that way but it would get us to FI a lot sooner.

JC,

I agree about optimization to a point. However, we are also about optimizing our happiness and not delaying all gratification for a later time. For example, we took a 4 day ski trip in February. Eight passes (4 days X 2 people) was about $700 alone. Factor in a rental car etc and we spend about $2,000 even with free flights. Was it optimal. No. Was it worth it to us. Absolutely. However, that type of spending makes our numbers look really bad. The way we track our progress it is the equivalent of having $50,000 less dollars. In reality, after FI we will never spend on a trip like that b/c we’ll simply live in a place where we’ll have access to the mountains. When we do travel, we’ll have much more flexibility in our schedules to travel on off peak times, etc. Therefore, I think getting in the ballpark is close enough, because we’re not going to have to support our same lifestyle and expenses that we do when working. Some things will be less and some more and we’ll have to see how it all plays out and be flexible anyways.

Cheers!

EE

I love your plan of supplementing retirement income with part-time work, especially doing something you love. While I haven’t worked out all the math yet, I intend to do the same thing. As a Registered Nurse, my plan is to eventually drop down to what is known as PRN status, meaning I would pick up a few shifts over the course of the month, thereby saving tens, or even hundreds, of thousands of dollars needed in our retirement nest egg. Alternatively, I also may consider the option of working as a travel nurse, where I would take a three month assignment, make $20-30k, and then retire the other nine months out of the year. The beautiful part of travel nursing is that it would also allow for free travel with my wife and son, as housing and travel costs are typically covered, as well.

There are so many options available, it sorta makes my head spin! lol

It’s like you said though, you have to be willing to do what is necessary and have the ability to be creative with how you go about making your dreams come true, whatever those individually determined dreams may be. While we don’t have a specific FI date yet, my current estimates put me at around 45 (29 now,) but with the addition of supplemental income, there is the serious possibility of being MUCH younger. Either way, I’ll certainly be retired younger than the average individual. Thanks for the excellent post; have an awesome day! 🙂

NOF,

I am also considering a traveling position as a physical therapist, especially in the first year or two after leaving my job as we can try out different parts of the country to decide where we want to settle long term, make some pretty good money in the process and have our housing provided. I’m not so big on the idea of part-time or PRN work as the one thing I do love about my job is the bond with patients and so I’d prefer to go all in for a few months and then take a few months off completely. I agree though that it is awesome to have so many options that are feasible and better than a traditional work schedule with only a couple of weeks of vacation in a year. It is also awesome that you’re thinking seriously about this stuff at 29. Good luck and I look forward to learning more about your journey.

Cheers!

EE

There is this little sentence that tells it all for me. It defines FI stage 1 that 1 want to reach

” We therefore believe that after covering our basics, it will be far easier and more fun to be creative with earning small incomes or being creative with spending in retirement while living with much more freedom compared to continuing lives that revolve around jobs just to save more money.”

As soon as I can get my mindset and that of my wife into this concept, I will feel like I have reached 90pct of my goal! I only wonder when this will be the case.

AT,

I agree that there are various stages of FI, rather than one day you’re not FI and the next day you are. This is especially true if invested in volatile assets as we are where it is conceivable to see your assets go up or down by substantial amounts in short periods of time. Therefore I think better to have some security and then know you’ll have to be flexible and willing to make adjustments as you go.

EE

Thanks for the mention! Mrs. SSC pointed out that in Whitefish, the ski resort pays ~$10/hr for part time work but like you mentioned you get a free ski pass. We hope to relocate near somewhere that offers a mtn for skiing/snowboarding, so we anticipate some sort of small income in that kind of way. We’re not factoring it into our forecasts though, in case we don’t ever have any income coming in.

We realize that scenario of never working again is very improbable, and that somehow in someway we’ll be getting some sort of income no matter how minimal. Any little bit will go a long way towards buffering the amount we have to withdraw each year which is a win-win. Plus, you get to meet new people, and get exposed to a different social circle. 🙂

You can probably guess that we’re in the “not working 3 more years” camp and will most likely get some side gig to help out.

Mr. SSC,

No problem, I love your concept! Just curious, but if you think that making 0 income is “very improbable”, why not just factor it in? Not being critical, just curious? We were in the same boat when we were starting out but have really changed our mindset on this a lot. The more I learn and think about things, I just don’t think the idea of a traditional retirement makes much sense with our personalities, and so don’t see much reason to plan for one as such.

Best,

EE

I completely agree with this line of thinking. Flexibility is a key part of our plan. And really, having enough money to confidently be able to turn down money is the first step. Having enough saved that we can say: “That money is not worth the trade off of our time.” While at other times, it will be (your example of ski patrol). Without this confidence and flexibility, the freedom is lost on both sides - you either have to work longer to have enough so you never accept money again or you have to work longer so you can overcome the fear of not having an income any longer. My first goal is to get us to that point where we can evaluate projects and say: “nope. I don’t want that money.”

Maggie,

We are definitely at that point where we are very comfortable turning down more money as Mrs EE never went back to full-time work after having the baby and has turned down some pretty lucrative consulting opportunities and a very interesting teaching gig in the past year. I also have cut back substantially at work as I’ve begun to gradually phase myself out and am being very purposeful about not trying to grow and monetize the blog as I simply want it to stay a small hobby that I enjoy and not another job. This is definitely a big first step on the path to FI, especially for those of us with kids.

Thanks for the comment.

EE

A lot of people think I pulled the plug too soon. I see it much like you do. A short term (fun) job effectively pays someone in my position 25 times the going rate. Haven’t needed any fun work yet though.

FV,

You’ve been telling me this for quite some time. Sorry, I’m a bit dense, but you’re definitely bringing me around to your point of view. Thanks for the ongoing encouragement.

EE

We’re all about the date, creativity, and flexibility. If we achieve our passive income goal to fully fund our lifestyle, great! If not, we’ll hustle-it’ll be a great opportunity to try new things or expand our side hustle. Being campground hosts is one of gigs we’ll use to cut our FI expenses. 🙂

Agreed! We have it pretty good as explained in our “Fail Upward” post which is why we’re still planning to stick it out until our date. However, I still question whether it is worth it as we’re (especially I’m) getting pretty antsy for some change.

Great post. I was going to suggest that you get jobs at ski resorts; then I read the next paragraph. There are so many hacks that can be done in retirement or even now that can either save you money.

I love the theater but it’s expensive. A few years ago, I started volunteering at theaters in SF. Now I work a show or two a month, then catch shows anytime I want for free.

Agree totally, IH. I recently wrote about teaching a rock climbing class at the local university which is located only a few minutes from our house. I only ended up doing that b/c I was told I wasn’t allowed to pay to use the wall b/c it was for staff or students only. I was persistent with it and offered to volunteer to help teach in exchange for use of the wall. Long story short, I now am paid to do something I would have paid to do. Travel hacking is another things we are working on and incorporating. There are many ways you can hack the system rather than simply paying retail and it is definitely easier and faster than saving 25X the cost of the item. The key is to continue to question everything and not get sucked into any particular way of thinking.

Best,

EE