Can You Handle The Truth About Investing?

We have written extensively about the mistakes we have made with our investments and the bad advice we have received. We have also been very critical of our former advisor and the financial industry. This could then lead to fair questions from a critic of my statements, such as “Why did you use the advisor for nearly 10 years?” and “If this advice was so bad, how didn’t you figure it out sooner?”.

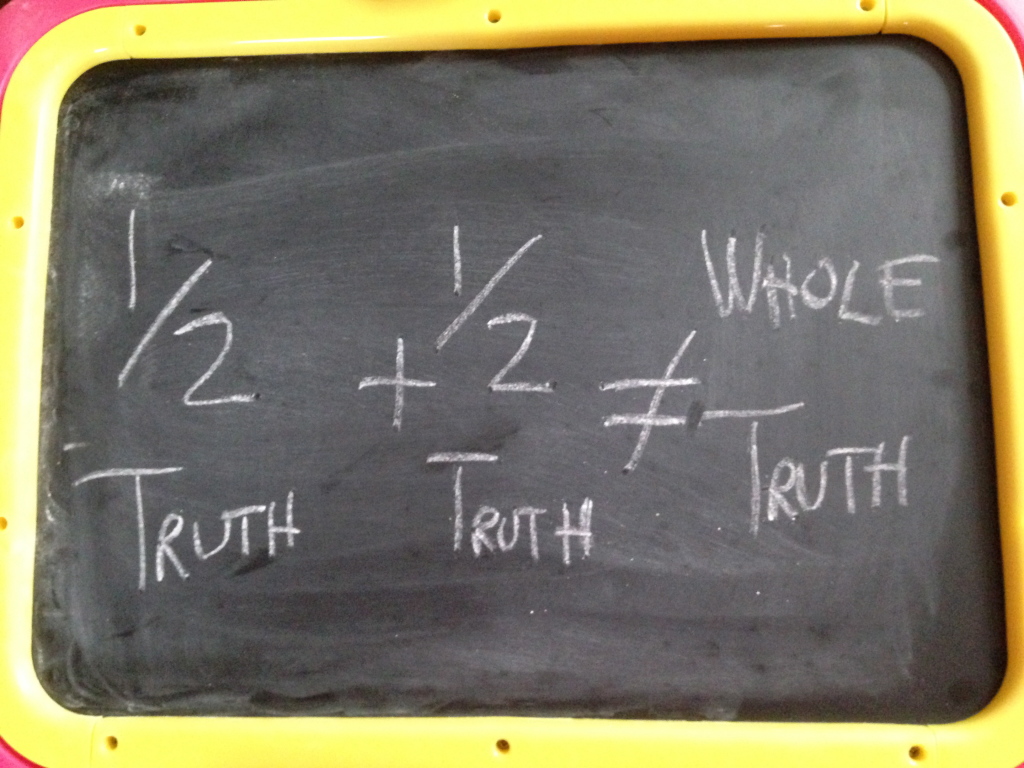

The problem is that the financial industry is built upon half-truths that are just plausible enough to seem true, and so they become conventional wisdom. We talked to many people since beginning to educate ourselves and starting this blog that either had similar experiences to our own or still are and don’t even realize it. Today we hope to shed some light on a few of the bigger half-truths that we were told and then give you the whole truth so that you can make intelligent decisions for yourself.

Half-Truth #1: A financial advisor is paid by charging commissions on the products sold or a percentage of your assets.

WHOLE TRUTH: An investment advisor is paid in many ways that are in direct conflict with your best interests, and many of them are hidden in the fine print of the prospectuses and marketing literature that very few people take the time to actually read.

The first statement is true, just not the whole truth. The whole truth is that advisors are also paid by hidden back-end fees tied into the expenses of the funds sold. They also are likely paid more by selling you particular products over others, incentivizing them to choose products that are not necessarily in your best interest. Before choosing any advisor whose expenses are tied to commissions on products sold to you or a percentage of your assets under management, be sure that you know ALL of the ways they are compensated and how they may create conflicts of interest. Be sure to ask about 12b-1 fees, expense ratios, sale of proprietary mutual funds or annuity products, administrative fees and all of the expenses of complicated investment products like variable annuities before committing a single dollar to invest. We didn’t, and we paid about 4X the already high fees we thought we were before figuring this out as we explained here.

Half-Truth #2: Your annual returns were X% for the past year (accompanied by fancy print outs).

WHOLE TRUTH: The numbers your advisor shares with you are the investment returns. They bear no resemblance to YOUR actual returns.

This is a BIG one that gets everyone coming back. Our former advisor, and the financial industry in general, loves to focus on investment returns. Every year we would sit down for an annual review with our advisor and he would tell us, “Your investments returned X%.” While paper returns do reflect the fund’s internal fees, it overlooks many other factors affecting your return. Let’s look at the other factors that make these numbers meaningless for an individual investor.

(1) Taxation is huge, but ignored by investment returns. Taxes can have massive effects on how much money you are able to invest and they can greatly reduce your real returns.

If you are a high wage earner and not utilizing a tax deferral strategy, you are paying massive opportunity costs by paying excessive income tax when you could instead be deferring the taxes, using that money to make investment returns, and then paying the taxes at a much lower rate at a later time. See this post for a full explanation of how this works and why an advisor is unlikely to promote this strategy. This can represent a massive opportunity cost of 25+% less money invested and working for you.

Then if you are investing in taxable accounts, you will pay annual taxes on your investments. Making matters worse, advisors have great incentive to not only have your money in these taxable accounts but to also place them in less tax friendly investments than you would be likely to choose on your own. This concept is explained in this post. Figure on losing an extra 1-2% just to federal taxes alone if investing in actively managed funds in taxable accounts. Over time, these taxes alone can leave you with less than 40% of what you would have had in tax advantaged investments according to Vanguard founder John Bogle.

(2) Front-end load fees have a huge effect on how much money you actually have working for you. Most new investors would be subject to paying commissions on their investments in the range of 5-6% of their money. This has a tremendous effect on wealth building and yet is not factored in to investment returns.

(3) Back-end loads or fees will take away from any money you have earned, meaning it was never really yours in the first place. Your investments may be subject to sales or surrender charges based on a percentage of your money when selling your investments. These again do not directly affect your annual returns. However, the more you earn the higher these fees are, and they have a huge effect on how much money YOU really have. This concept is explained in more detail here.

Half-Truth #3: You need to diversify your investments.

WHOLE TRUTH: You need to diversify your investments. However, you should not confuse diversity with complexity.

The financial advice industry loves to make investing seem complicated. It is how investment advisors can justify their existence. This is the biggest reason we used an advisor due to feelings of fear or inadequacy to do things ourselves, and continued even when we started to sense we weren’t getting a good deal. Advisors claim they can manage this complexity for you and choose the “best investments”.

Reviewing our final statement of the accounts sold to us by our investment advisor, we owned 15 different mutual funds across our different accounts and within a variable annuity, none of which we truly understood. With all of these funds, we had much complexity. However, at the end of the day we owned only 3 different asset classes: large cap domestic stocks, small cap domestic stocks and domestic bonds. Knowing what we now know, we own these same asset classes + international stocks and real estate investments with a grand total of 7 different funds. This diversification gives us a better chance to have higher returns with less volatility. We have far greater diversification with 50% less funds and only 5% of the all in costs of the funds chosen by our advisor. Investing should not be complicated or expensive.

Let me conclude with this. We want you to have the whole truth.

Actually, we can handle the truth and we deserve it Jack!

Investing in stocks can be a great way to grow your wealth. However, most investors actually lose money investing in the stock market. Behavioral mistakes and lack of knowledge could cost you even more than we spent on bad advice. Whether you chose to become DIY investors as we have or choose to use an investment advisor, you must take responsibility to become an educated consumer. Otherwise you, like we have in the past, are simply handing over your hard earned money and accepting all of the risk for a financial industry that will happily reap the rewards. That is the whole truth!

*Thanks for reading. If you enjoyed this content, you can find my current writing at Can I Retire Yet?. Enter your email below to join our mailing list and be alerted when new content is published.

Wonderful article, Elephant Eater; I thought your ‘whole truths’ were very helpful. My husband has been thinking about going to an investment advisory service, but we’ve never worked with any before. I’ll have to show him your article, and see if it helps him make a choice. Thank you!

Thanks. I’m glad this was useful to you. Any time you spend educating yourself before committing any money will be time well spent. I hope you’ll read on in my DIY investing articles and resources. Even if you decide to not go that route and you seek help from an advisor, I think the information shared will be very helpful and valuable in making wise choices.

Cheers!

EE

I am an amateur in the financial industry and have entry-level knowledge of stocks and bonds. Initially it looked like your article is for people like me, but I was wrong. You throw around some big words and phrases, and then talk about making things seem simple that have been complicated unnecessarily. I got the overview of what you said, but not all of it was crystal clear.

Rushil,

Thank you for your feedback. I try to write articles to simplify what the financial industry makes so complex. Like you, I started with very limited knowledge of stocks and bonds. I felt that I could just trust an advisor to handle things for me. In the process I made some extremely costly mistakes. You certainly can not learn everything from one blog post or even one blog, but there is a lot of great info out there and it is definitely not as hard as you may think to figure things out. If I can clarify any points, answer any questions or steer you in the direction of specific resources I’d be happy to do so. That was my whole purpose when starting this blog. Best of luck on your journey!

EE