May Update!

New Way to Share Progress

We updated our assets and expenses for the month. We decided to start sharing the information on our FI progress through a post that will be done around the first of the month instead of tracking it on a separate page. That page was getting too long! You can still refer to that page for prior updates if you want to see how we progressed since we started tracking this. This lets us share a little more without worrying about space constraints.

We’re not sure why anyone really cares about our personal information, but in communicating with other bloggers it seems the more personal you get, the more people seem to be interested and follow the blog. One year into the blog, our most popular posts are definitely our personal story rather than the technical points. So for all of you financial voyeurs out there, here you go;). For us, this holds us accountable, keeping us on the road to financial independence.

This Month’s Results - Not Any Closer to Financial Independence

The numbers weren’t in our favor this month. On the bright side, we didn’t go down in asset value, but even with all of our monthly contributions, we only saw a slight increase in assets. A measly .78%. And to add insult to injury, our average 12 month expenses went up slightly. March was a killer month for us expense-wise. A new bed for Toddler EE, our annual snow tubing outing which serves as Christmas gifts to all of the kids in the family, our ski season passes, taxes, and some home repairs. When it rains, it pours, right?! Our March expenses were DOUBLE that of other months. We did get back on track in April though, even with a major car repair.

Not much changed on the investment side for us. Still maxing out each month to our employer sponsored plans and then investing Mr. EE’s after tax pay to our taxable accounts. We are now working on re-allocating for the year to make sure our portfolio matches our investment plan as far as how we want our money invested. That is this month’s project.

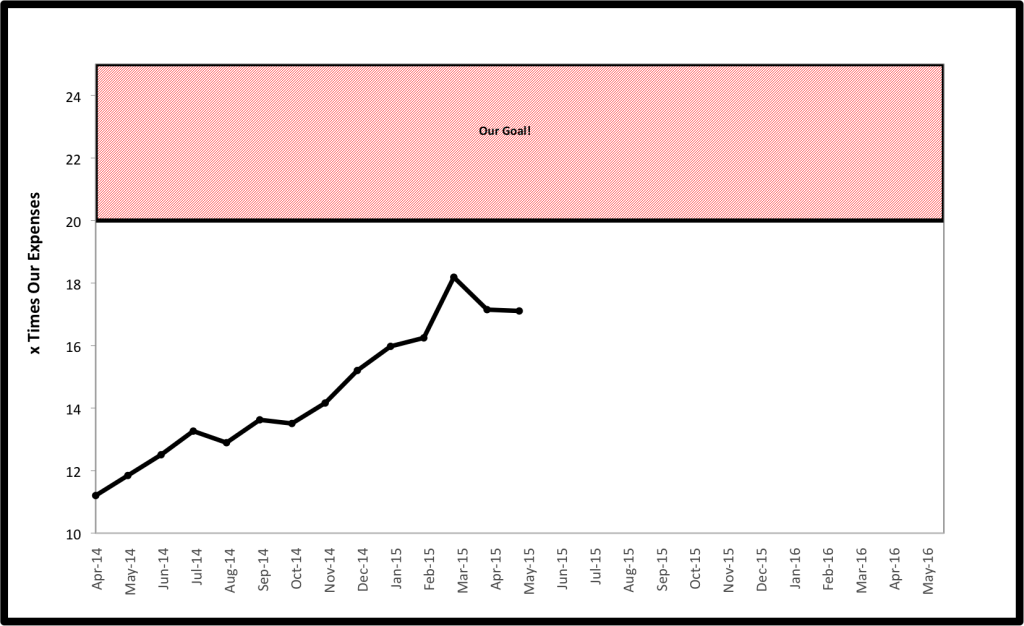

So where does this get us as far as the path to FI? Well, if you check out the graph below, we slipped quite a bit since March of this year. Our savings was over 18x our expenses. We are now down to 17x. Part of that is we changed the method of calculating this ratio. Prior, we were using just the prior month’s expenses. We decided to change that to a moving 12 month average because that would be more realistic, and we wouldn’t see the big fluctuations in the ratio. Some months have heavy expenses and others very low. Bottom line, we were looking more promising a few months ago, but we are still doing very well and are well on our way to meeting our goal. As of this month, exactly two years to go to meet the goal! For those who haven’t followed this tracking, our goal is to be at 20-25 times our expenses by May 2017 so that we can retire early (by the age of 40). As of now, we are at 17x and moving along. Keep following us to see if we can make it!

*Thanks for reading. If you enjoyed this content, you can find my current writing at Can I Retire Yet?. Enter your email below to join our mailing list and be alerted when new content is published.

Top recommendations

Hang in there. Setbacks are temporary. If I can FIRE at 40, anyone can.

Does a goal of 20x mean you are planning on a 5% withdrawal rate or is there a supplemental source of income?

Thanks for the encouragement. We never really tracked our spending or our investment performance until taking control of our finances and starting the blog about a year ago. We had a couple of major expenses over the past two months. That said, as much as anything the setback was an accounting issue as we try to determine the most accurate way to track our progress. We think the current system should be pretty good.

As for our 20-25X goal, yes that would just be the inverse of a 4-5% WD rate. Over the next few posts, we’ll expand on our plans and views on how to use the 4% rule for an early retirement. Until then, I’ll just say that yes we will continue to have some earned income in the early years of our retirement with many more details to come.

Just curious if you don’t mind sharing but are you living solely off of investment income or do you have any earned income?

Cheers!

EE

We had a setback in April, too — mostly an unexpectedly large income tax bill. But we know, and sounds like you do too, that things will come back around with continued focus. Overall, it still seems like you guys are doing incredibly well and are so close! Based on your comment back to FV, we’re looking forward to reading your early retirement income plan!

We’re working on a series of posts that lays out the several ideas we have. We don’t have an exact plan yet, but we really want to work toward developing location independence as well as financial independence as we are torn between wanting to live near our families in the east and wanting to pursue our love for the mountains in the west. We have multiple options that could meet our goals and desires.