October Update

Back on Track

Back on Track

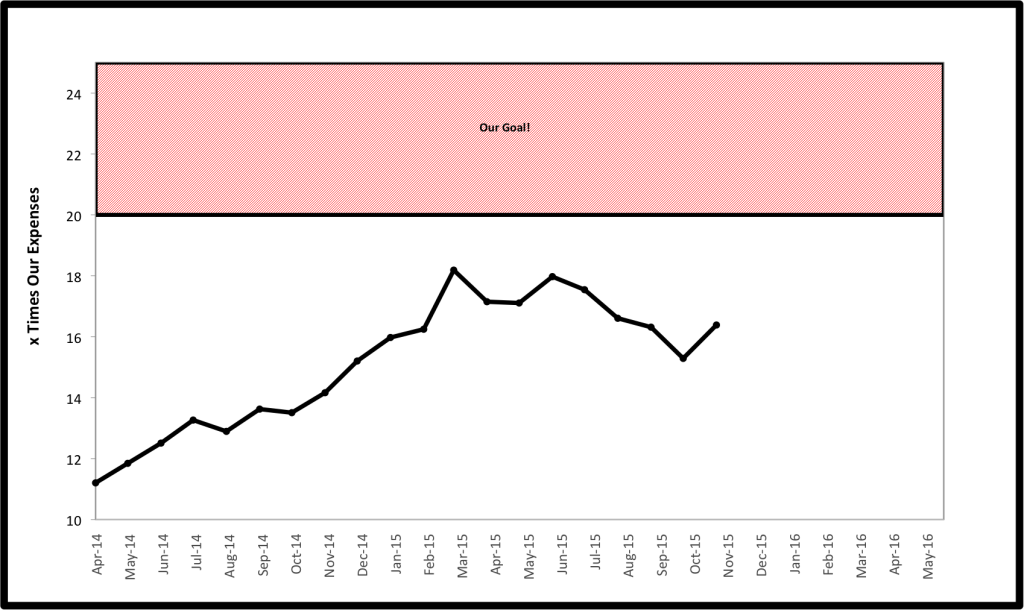

It was a good month for our investments across almost all asset classes as our portfolio value jumped 4.8% in just the past month. At the same time we had a very good month on the spending front, dropping our average monthly expenses by $90. This took our assets from 15.3X to 16.4X annual expenses in the course of just one month, finally making the graph look a little nicer again!

Crossing the Line

When starting out investing, the amount that you save is by far the most important determinant of your net worth when tracking on a monthly or even yearly basis. If you have only $10,000 or even $100,000, a 10% gain or loss in the market is almost unnoticeable if you are plowing substantial contributions into your investments regularly. You can simply buy through all but the biggest up or downturns and pretty much always see steady progress. However, you at some point will cross a line where this is no longer the case.

Once you obtain a substantial net worth, market fluctuations will be the primary determinant of which way your graph is moving. We have crossed that line. Over the previous 4 months, we have been continuing our regular investment buying schedule (actually adding even more per month since September) and yet we saw progressive major drops in our net worth. This month, we continued the exact same path and saw the graph take a big jump upward.

For a couple of control freaks like ourselves this is a bit of a weird transition. On one hand, it makes us feel very good to know that we have built the capital where the gains in a single good month like this one could possibly sustain us for an entire year. At the same time, it is a bit like being caught in a riptide in the ocean. We see that we have little control over the direction we are being pulled.

We know we have to simply stay calm and ride the waves whichever direction they are taking us. It is now a matter of simply trusting the processes and plan we have developed.

Trapped In Comfort?

Another of the unique thoughts to someone working towards early financial independence that we have been discussing recently is the idea of being trapped in comfort.

I regularly follow the blog Slowly Sipping Coffee. Mrs. SSC has been chronicling the process of layoffs within her company and thinking about options if she lost her job. Recently, she posted how things finally played out. Spoiler alert: “And I didn’t get laid off. And I am disappointed.” I would assume that at least 90% of Americans who cling to a paycheck to paycheck lifestyle couldn’t comprehend reading a statement like that, and I’m sure more than a few would get resentful or even angry reading it. However, I get it completely.

I am not one of those people who want to retire because I hate my job. I am a physical therapist. My work is ofter very rewarding. I work with different amazing and inspirational people every day. I work in a fun environment and am compensated very well for doing it.

However, I also don’t love my job anymore. The amount of time required to perform aspects of my job that I don’t like such as doing paperwork are massive. The one part of my job I do like, working directly with patients, requires me to keep a schedule and does not allow for freedom of my time.

I simply like my job. I spend every day not hot nor cold, but lukewarm. So should I just quit?

I personally think not. We know that the grass is not always greener on the other side. After looking at the big picture we know that we are choosing the path that makes the most sense to us on many fronts for long-term lifestyle while living a pretty decent short-term lifestyle in the process. We therefore plan to stay our course.

We however also know that we have positioned ourselves financially where we would be fine if one (or even both) of us lost our jobs. Losing a job could even be a good thing because it would force us to take on a new challenge that we may like and/or benefit from even more. Being let go would make a decision that we deep down want, but aren’t ready to make on our own.

So while much of the world may look at Mrs. SSC as crazy for being a bit bummed for not losing her job, I just wanted to let her know that at least there is one other crazy person out there that relates. Here’s to hoping we can both lose our jobs soon! Until then we will continue on with the admittedly first-world problem of being trapped in comfort.

A Little Light In The “Black”!

Almost daily, we are bombarded by spam from companies telling us about the next greatest ever, limited time only, must buy now offers. When I saw a message in my inbox recently from REI, I assumed it was another one. I’m not sure what prompted me to open and read it, but I was pleasantly surprised when I did. In the e-mail, REI announced that they would be closing all of their retail stores on Black Friday to be consistent with their company mission to allow their employees a day to be outside.

I often times feel that as I write my criticisms of our hyper-consumer culture that I come across as some anti-capitalist, anti-American extremist. To the contrary, I am very pro-capitalism and pro-business. By investing primarily in stocks, I am banking the future of my family on this system. I feel captilism is the best hope for solving many of the problems that our society faces.

I don’t believe profit is evil. However, when people care ONLY about profit and are blind to everything else, I think it can become evil. I love to see people and companies make money by being innovative and bringing value to consumers.

I think that we need to support companies that do the right thing and help promote those companies. It is why I do whatever I can to promote and highlight Vanguard as a light in a sea of darkness that is our financial industry.

If you agree that REI is doing a good thing by pushing back on the Black Friday “Holiday” that is the biggest retail day of the year, then show them with your wallet if buying any outdoor products for yourself or gifts this holiday season. Help them spread the word about #OPTOUTSIDE. Maybe if other companies see that this can be successful, they will follow course and begin to restore Thanksgiving to a day of family and gratitude rather than just another day of shopping.

Have a great November! Feel free to share your progress and agree or disagree with any of our ideas in the comments below.

*Thanks for reading. If you enjoyed this content, you can find my current writing at Can I Retire Yet?. Enter your email below to join our mailing list and be alerted when new content is published.

Top recommendations

This comment is about agreeing with everything! 🙂 We’re caught in that same riptide, too — and, yeah, it’s great we’ve built up the net worth, but also scary that we no longer control our own destiny. But hooray for hitting a new peak! Like you and Mrs SSC, we would LOVE to be laid off and get severance packages. And we definitely respect what REI is doing. I’ve seen bloggers tell others not to share their ads or the opt outside hashtag, but I don’t see any other way to change consumerism. Other retailers have to see that it’s in their best interest to stop the madness, or things won’t change.

I actually have a bit of mixed feelings about REI. They have moved into our area and shortly thereafter we saw our local climbing shop pushed out of business which was a bummer for our climbing community. However, I think they’re a pretty decent company with their awesome return policy, garage sales, online outlet, etc and I definitely feel that they’ve got this one right.

Whew! I’m up to about 5 people now that don’t think I’m crazy! Seriously, when I got my offer letter saying I wasn’t laid off, my eyes teared up. It is so true how comfortable you can get in a cozy job with a sweet paycheck. I think one of my co-workers said it best when she said it would seem irresponsible to quit such a cushy job to pursue motherhood or a lower paying job you are passionate about (in my case teaching). But, for now, I will take the extra money and keep investing it, and see how things go… but I am optimistic that this may be my last employed holiday season!

Irresponsible to want to be around for your kids more or pursue things you are more passionate about? That sounds crazy in my book!

I hope everything works out for you over the next year so you are on a new path for the next holiday season.

Keep being crazy. Being normal is pretty boring!

It’s nice when you’re plowing money into your investments and it looks like it keeps going up every month no matter what the market does. That will be an adjustment when market swings start to affect it more and our deposits become a smaller effect.

I also got the REI email about closing on Black Friday! I was pretty surprised and think whoever came up with that is a marketing genius and probably makes them more money in free marketing than if they stayed open. Go REI!

I agree that REI came up with a good marketing strategy and is getting a lot of free publicity from people like us talking about it. However, I think it is a pretty big risk on their part. I hope it works out for them and maybe starts swinging the pendulum back a bit toward sanity before Black Friday starts creeping in on Halloween!

Nice update, Mr. EE.

REI is an interesting company. They’re similar to others that balance profits and core-values like Patagonia and Whole Foods. I have been very interested in social entrepreneurship where you blend the efficiency and resource discipline of capitalism with the “make the world a better place” missions of non-profit and non-business organizations. I really like the books Banker to the Poor and Building Social Businesses by Muhammad Yunnus. He won a Nobel Prize and has really spread the idea of a different kind of capitalism.

I’ve luckily not had the same experience of hoping to be fired. My own entrepreneurial path has made me want to quit sometimes:), but overall it’s had more flexibility to start, stop, or slow down (mini-retirements) when needed as opposed to pushing hard until a final jumping off point.

You’re sounding more and more like a real estate investor all the time! “Control-freaks-are-us” would be another way to describe real estate oriented people. I like owning a rental that cash flows and amortizes a loan in 15 years better than hoping the stock market goes up (yes, I know it will, but STILL). I see more certainty and better timing with the equity growth using the rental, but I like blending it with index investing, too.

Enough from me. Cheers!

I’ll definitely add those books to my reading list. I’ve never heard of Yunnus. As I look beyond planning for ER to what we want to do with the rest of our lives “social entrepreneurship” is definitely on my mind.

Our real estate exposure to this point has been our primary residence (an expense and not an investment) and owning REITs which are basically just a high yielding stock index fund with the same lack of control. I am definitely interested in RE as part of our plan going forward as we look to do some creative things in our early retirement.

Thanks for sharing your insights.

Gogogogogogo! There needs to be an online place for the FIRE club. Not the people aspiring, the ones who are already there. Maybe I’ll start it. You can be the first to join me!

Hint taken my friend!

I too almost wish I could get laid off. I run a large company and am extremely well paid to do a job I have loved for most of my career. However I just sort of like it now, not love it. It is hard to walk away from what feels like big money even if I don’t need it. I have at least 50% more saved now than I will ever spend. I’ve been ambivalent about my career for a year now, and sometimes think anything, even forced termination, might help me move on to the next chapter of my life. Ironically I’m very good at what I do so it is unlikely that even a mostly non-motivated me won’t be the company’s best option to run thinscompany for a few more years.

Steve,

I’m envious that you have already over saved. I don’t plan to get to that position as I already have numerous ideas where I want to turn my attention next.

An idea from Todd Tresidder that has really stuck with me when starting down this road to FIRE is that you should not retire from something that you hate, but that rather that you should retire to something new, exciting, challenging or different. Maybe thinking about things from that perspective will push you in the direction you need to be looking to next.

Best to you and I hope you’ll continue to read and contribute,

EE

I love how you calculate your progress in terms of annual expenses. Very clever. And excellent progress. I’m excited to keep following the journey!

Thanks for the feedback and we’re happy to have you aboard!