July Update

A Small Step Backward

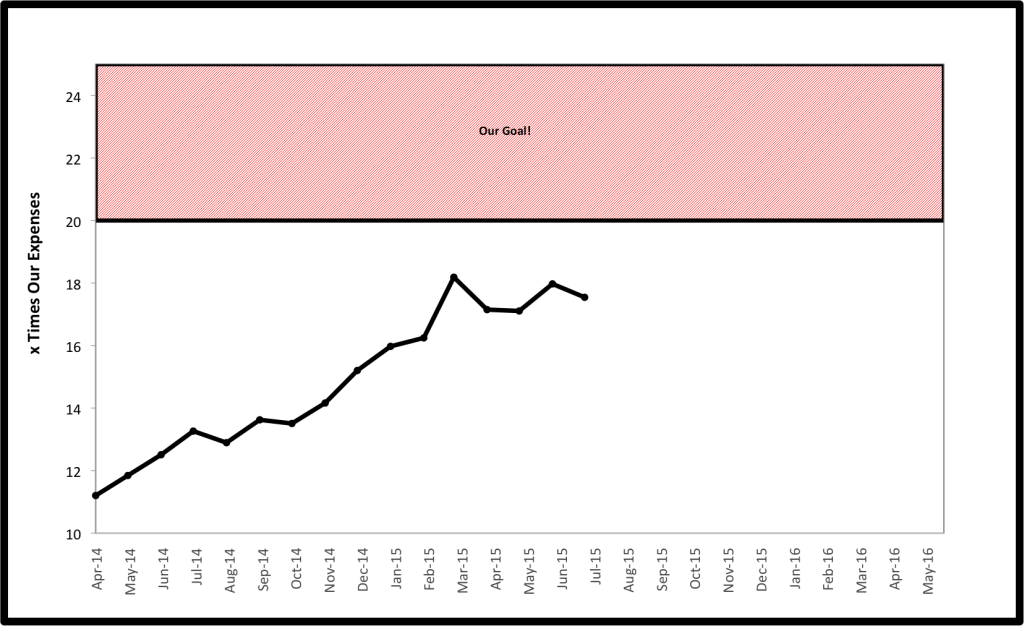

This month we saw a drop in our investment value. At the same time our rolling monthly spending average went up by nearly $80. This took our investments from 17.97 times our expenses down to 17.54.

Unfortunately, next month doesn’t look a whole lot better. While we never try to predict the market, we are sure spending will again be going up as we have a major renovation project going on at the house with a bill soon to follow. Such is life.

Psychology of Investing

We saw no visible progress towards our goals this month as the value of our investments dropped by .29% despite our continued large monthly contributions. This is the downside of monitoring your investments regularly while investing in volatile asset classes. It is a bit painful to know that I worked a full month to contribute both full pay checks to my 401(k) and taxable investments while Mrs. EE contributed her monthly $1000 to her Simple IRA and put some money into savings. We also received and reinvested all quarterly dividends and interest on our mutual funds this month. At the end of the month, we have (on paper) less than we started with.

This is where understanding your investments is vital. Since the light bulb went on in our head a few years ago as to what we were buying and why, we have been selfishly hoping for a drop in the market. We want to buy as many shares of the funds we are invested in as possible. (We would also benefit by paying less in capital gains taxes to sell off the expensive and tax inefficient mutual funds we bought through our advisor years ago. Learning financial lessons isn’t cheap!)

This is why I write frequently about the whole 25X number being rather arbitrary. While in the accumulation phase, most of us in the FIRE community like to chart our progress for motivation. Market gains and higher valuations make our charts look pretty and make us feel good. However, lower values are actually far better for us as we want to buy as many shares as possible now. On the flip side, we want the market to soar and stay high when we are on the spending side as we want to cash in as few shares as possible to keep our money working for us as long as possible.

As markets have been sputtering a bit recently and a correction could be coming, it is a good to remind ourselves of this. Stay the course!

*Thanks for reading. If you enjoyed this content, you can find my current writing at Can I Retire Yet?. Enter your email below to join our mailing list and be alerted when new content is published.

Top recommendations

I like the way you plotted out your goal as how close you are to 25Xs. I have that column in my spreadsheet where I track budgets, but I’ve never plotted it out. On a side note - I’m curious - do you ever wonder if 25Xs or 4% will be enough? Sometimes we struggle with that… I think we both have a fear that we are being stupid to give up high paying jobs… For us, the psychological effect of all this is harder to come to terms with than the money part.

Will 25X be enough? I don’t know. I know we don’t plan to decrease our current spending much in retirement and could imagine scenarios where it increases. We also don’t want to live with a “poverty mentality”. We have never really had a budget and don’t look forward to living our life that way. Therefore, we don’t plan to do a traditional 4% WD plan in retirement. I have a post in my drafts that I will someday soon finish, just no promises when, that fully explains our plans.

Keep plugging. Almost there. Gogogogogogogo!!!

Thanks FV! Finish line is in sight.

Glad you’re not getting disheartened. It’s a marathon, not a sprint after all. I bet your chart will look a whole lot more healthy very soon. I always try to remember that progress IS being made.

Agree! That’s the part we need not lose sight of. As long as we’re pouring in large contributions regularly, we’re actually doing much better as we buy more shares when the market is down. While we love to see the graph going up psychologically, it really doesn’t matter what your value is on paper on any given day.

Yeah thanks for the reminder. Also for people in retirement if, they are not doing extensive travels, expenses tend to go down. So that 25X goes a little bit further or acts as an additional buffer to exceed expenses.

We think our expenses could vary a bit from year to year so are working on ways to develop additional income in retirement. That said, you make a good point. There are many areas where I see our expenses decreasing dramatically including eliminating day care, eliminating my work commute, downsizing our house and going from a 2 to a 1 car household.

Oh man, we had the same WOP WOP happen at the end of the month. We completely agree — we want the market correction, we want to buy more now, but it still stabs us in the heart to see all of our hard work saving and investing result in a net loss. Our mantra: Think long term. Think long term. Think long term. 🙂

Totally agree to think long term!

I’m at the beginning stages of my journey and that made last month’s sad ending much easier to handle. I’ve been trying to focus on how many shares I own, instead of the value. That way market drops are just big sales. I like sales. 🙂

Good luck getting through the rest of the summer with your expenses. Stay the course!

That’s a great perspective Kate. If you are in the buying phase, especially if just starting out, any drop in the markets means you get the chance to get more bang for your buck as your shares go on sale.

Thanks for the comment. We’re definitely staying the course.

EE