June Update!

It was a good month!

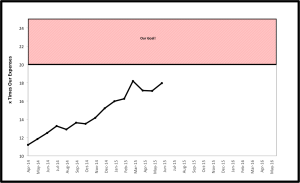

We are now close to 18x our average expenses. That is up from 17x last month. That said, as you can see by the graph, we’ve been here before. We were seeing a steady 1.5% or so increase in our assets each month (give or take based on market fluctuations), but in May, we had a 2.5% increase. That’s great! There are several things that we can attribute the increase to. We continue with our regular automated contributions. We also were able to add some extra cash to our investments this month from excess that had been building in our checking accounts.

In addition we had a low spending month (less than $2,500), taking our rolling 12 month average monthly expenses down by $90. This is a big reminder that lowering your expenses is the fastest way to achieving financial independence. The increase in our savings plus the lowered expenses led us closer to our goal.

What did you spend on Mothers Day?

We could have had potentially higher expenses with the Mother’s Day holiday, but we didn’t. I read that the average person spends $170 for Mother’s Day. Why? Does an expensive gift really tell your mom how much you love and appreciate her?

We took the weekend and spent time with family. That is what this mom wanted - quality time with little EE where we weren’t running everywhere, paying only half attention to her, or scrambling to get things done around the house. We took a hike on a beautiful blue sky Sunday afternoon. It was the perfect Mother’s Day gift.

We wanted to spend time with our moms too, so we had a cook-out on Saturday, the day before. We had everyone come to the house, cooked out, and just enjoyed the beautiful day and company of family. Our moms were very happy with that because they got to see all their kids and grandkids together, kick back and relax.

Total cost for 3 moms that weekend - maybe $50 in extra groceries and drinks. It wasn’t about being cheap and not buying a gift. It was about what truly matters and is important to us and our moms - time…not material things. Just a thought for when the holidays come around again!

Cheers!

Mrs. EE

*Thanks for reading. If you enjoyed this content, you can find my current writing at Can I Retire Yet?. Enter your email below to join our mailing list and be alerted when new content is published.

Top recommendations

Good progress! And thank you for being the voice of reason around gift-giving — it’s shocking how much we keep seeing other bloggers report on mothers day gifts, fathers day gifts, graduation gifts… It’s like all of the frugality goes out the window and, worse, like you said, the sense of what’s important. What mom wants STUFF instead of TIME with her kids? No moms anywhere, ever. (Or at least not good ones!) 🙂 We’re far away from our moms, but put homemade cards in the mail and plan on a nice long phone chat on the important days, and that seems to cheer them as much as any gift could.

Thanks!

We hate the whole gift culture associated with holidays and birthdays. We do just go with the flow at times because sometimes it’s just easier but we really try to emphasize doing something and spending time together rather than just exchanging material gifts that neither party really wants just for the sake of giving something.

Love your dedication to spending time together - not buying things!

It is a win-win for everyone!

I have just started following you and am curious if you have balanced your stocks, bonds, cash with any real estate investments. (Sorry if this is somewhere in a post that I haven’t seen yet!)

Real estate allowed my mom to retire in her early 50’s and I am aiming to follow in her footsteps. When the market crashed, her income properties just became more popular as people lost their homes. My couple of small rentals that I have so far have been income producing and seem to do a good job keeping up with inflation.

Thank you for sharing!

To us time over things is just common sense, but it can make things awkward from time to time as giving gifts is a huge cultural expectation.

We have our investment plan laid out here. http://eatthefinancialelephant.com/the-elephant-eater-investment-plan-and-asset-allocation-2/

What we actually own is a bit different than this as we continue to sell off some old assets and are rolling over a retirement accounts. We will post what we actually own in a couple of weeks once we finalize those transitions.

Unfortunately our only real estate is in REITs and our residence at this time. We would love to add a few investment properties and are reading up on that and looking at an opportunity now. I think there is a ton of upside in real estate if done right. Kudos to you and your mom as it seems you’ve already figured that out.

EE