What If…?

This past Wednesday morning, people woke up to something that very few people in the world could have predicted… I actually used my Twitter account to send out a tweet! (Oh and there was that whole election thing, too).

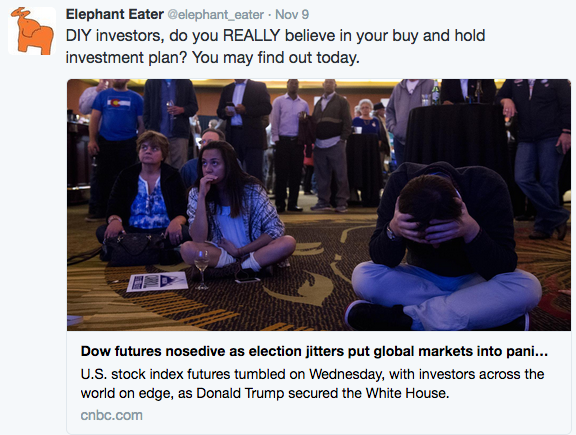

Little EE was up crying with an earache Tuesday night, so I laid down in her bed to comfort her, and we both fell asleep early. I picked up my iPad to check the election results early Wednesday morning. I was shocked to see that Donald Trump had been elected president. The very next headline I saw was about financial markets and panic. It prompted me to ask my followers a simple question:

By the end of Wednesday, markets were up. By Friday stock markets had one of their best weeks in the past five years. Life goes on…for now.

By the end of Wednesday, markets were up. By Friday stock markets had one of their best weeks in the past five years. Life goes on…for now.

However, that initial panic and uncertainty had me asking myself a simple question.

What If…?

Part of planning for FIRE is to plan for worst case scenarios. Some scenarios can be addressed with simple planning techniques such as diversifying an investment portfolio and having a written plan that you stick to when others are panicking. Other scenarios can be addressed with insurance products. I’ve written and will continue to write about this type of planning in the future.

However, that is not what I’m writing about here today. Some risks and events have impacts that are too large and wide ranging to be diversified away or insured. Today I want to address how we avoid the angst and anxiety that cause people to do irrational and destructive things. This can include the relatively benign losing money in the stock markets because of panic. However, it can be much worse as seen with people causing themselves stress that negatively effects their health, relationships, and even leads to spikes in calls to suicide prevention hotlines following elections or other trying events.

Today, maybe you are worried about the fallout of the election and the effects on affordable health care, the economy, wars abroad, or peace at home. Maybe you don’t care much about the election, but worry about other big issues over which you have little control. These could include health issues you or someone you love is dealing with, general economic uncertainty, a changing world dominated by technology and artificial intelligence, or concern about the environment.

We follow a few principles that allow us to get beyond these “what if…?” scenarios. These principles are vital to achieving FIRE while living a happy life on the journey and having true financial freedom in retirement.

Live for Today

We all like to think that good financial habits will make us wealthy and happy. Exercising and eating well will give us good health. Being a good parent will result in our kids becoming the adults we want and lead to a lifelong loving relationship. Electing the right leaders will make the world safer, more fair, and more prosperous. However, nothing is guaranteed.

We can shift the odds in our favor, and we should continue to do so. However, we can never know what the future holds. We can seize today.

I personally don’t care much about politics, but I can relate to the angst that people are feeling about things out of their control. When learning about investing, I spent hours agonizing over an optimal asset allocation and got ultra-focused on increasing savings rate, thinking that a few more dollars would make me happy. It won’t. Mrs. EE gets frustrated when she has symptom flares related to a likely autoimmune disorder. Stress only makes things worse. I think any good parent feels angst about doing what is best for their children. Ultimately, they will grow up to be their own people.

In each of these cases, we can not determine the final outcomes. We can focus daily on the things we can control. We try to allocate our resources of time and money each day on doing the things that allow us to enjoy the journey. We continue to spend freely, both time and money, on things that enhance our relationship with each other and little EE. We continue to try to learn a little more and live a little healthier each day.

We are not on the optimal path to FI, either of our health can deteriorate, and there is no predicting what will happen with little EE. That is OK. No one will ever be able to take today from us. Cherish the simple things.

Take Ownership

While we can not control all of the things that we worry about, virtually nothing is completely out of our control. I just completed the book “Extreme Ownership, How Navy SEALS Lead and Win” written by former SEALS Jocko Willink and Leif Babin. Extreme ownership is essentially the opposite of playing the victim card. It is an approach rarely modeled by the two presidential candidates, who managed to blame a multitude of factors for their shortcomings.

Ownership can be overwhelming with the types of “What if…?” worst case scenarios. It can seem unfair and make things even harder in the short term. It can seem like blaming the victim. However, taking ownership of your fears and issues is also the only way to grow, improve and avoid repeating your mistakes. Even though we can not control all aspects of a situation, we must take ownership of the situation we find ourselves in.

As related to financial independence, we all have slightly different definitions of what that means. The reality is that no one is truly independent, not dependent on others. We are dependent on reasonable market performance or having people able to rent our properties for income. We are dependent on having a healthy food and water supply. We are dependent on a system that provides affordable health insurance. We are all dependent on having general peace and prosperity. No one is independent, financially or otherwise. It is reality and we need to own it. Only then can we develop robust plans and strategies that can’t be taken away by one change to the tax code or a bad decade or two in the markets, let alone something bigger.

A lot of people are feeling hopeless because of a Trump presidency. There will be a Trump presidency, because a lot of other people are hopeless and have tied their hopes to someone else making them “great again”. No one has ultimate power over your life, unless we give it to them. Take ownership today.

Find Meaning

Viktor Frankl wrote the amazing book, “Man’s Search for Meaning” to share his experiences and observations of surviving in Asuchwitz and other Nazi concentration camps for four years during WWII. His conclusion is that there is meaning in all aspects of life, even suffering and even death. The ability to find meaning and purpose is often what separated those who survived and those who did not.

Often we get caught up seeking happiness by reaching a goal, obtaining objects, having more money, or romanticizing a lifestyle. Rarely do these things or accomplishments give us lasting happiness. Instead, maybe we should be looking for purpose and meaning. When we have purpose and look for meaning in life, happiness can just happen.

If this election and other recent events around the world teach us anything, it is that there are a lot of disaffected people out there looking for something. It sounds like a lot of opportunity to find purpose for those in this community who are in position to do amazing things with your lives. Will you?

How do you deal with things out of your control? How do you plan for worst case scenarios? Share your thoughts below.

*Thanks for reading. If you enjoyed this content, you can find my current writing at Can I Retire Yet?. Enter your email below to join our mailing list and be alerted when new content is published.

Top recommendations

Typically, I do the usual when things are out of my control, which is fret, worry, and generally stress about it. Then something snaps and I either accept it and move on, or find some way I can do something about it, both of which are a way of me taking the power back from whatever it is that’s out of my control.

I found myself explaining risk assessment to a classroom recently when I was giving a talk about O&G exploration. They kept asking, “But what if you don’t know?” I said, “You never know until you put a well down there, but what you can do is assess it to the best of your ability with the best data you have available. Then you assign the appropriate risk factor. That’s pretty much all you can do.”

I take the same approach with our finances and portfolio and FIRE assumptions. Noone knows the future. We just make the best assumptions we can with the data we have available and put it a risk level that we’re comfortable with accepting. Deep down, I think that’s what we all do. Some people’s risk tolerance isn’t as high, so they work longer, and save more, just in case. Nothing wrong with that, but I’m comfortable trying something different even if it’s out of my control and a bit riskier than the status quo.

Agree with your approach and philosophy 100%. It is really tough planning things with so many moving parts that are in many ways out of your control. It seems easy when you start down this path and read about the 4% rule, ACA subsidies, tax advantages of ER, etc. Then you start to realize that 4% rule is really tough to apply b/c spending needs can vary considerably with a long time span and kids. 4% rule is based on really good data over a really long time, but this is an extremely rare time with exceptionally low interest rates for about a decade already, so maybe this actually is a time it doesn’t work? Tax laws can change overnight, as I’m afraid we may see with lack of ACA subsidies potentially crushing the plans of many in our community. It all can become overwhelming, and scare people. This is why we are embracing a plan similar to your FFLC. Lots of flexibility to adapt, potential for meaningful work, and most of the upside of traditional retirement.

You’re speaking my language in this one, EE! Love it.

Man’s Search For Meaning is the go-to example of how we always have a choice in life. Frankl lost every freedom possible in the concentration camp EXCEPT his imagination. He could imagine the horrible experiences being teaching stories to inspire others. And they were!

I’ve got Extreme Ownership on my read list. My observation in many realms of life is that the strongest (as in, mentally/emotionally strong) have this trait of extreme ownership. You can either complain and become a victim, or you can respond and act with courage.

I often found myself stressed early on as an entrepreneur, especially during cash-strapped times. When I looked at it, this stress was usually focused on me and internally I was complaining or thinking “why me.” Every once in a while, I’d somehow shift focus to what I could control — like providing excellent service to someone else — and the solution to my stress usually magically appeared.

Life is certainly serious. But it can also be a game. The game is how can we get better at responding to the endless barrage of challenges. I like games a lot better than letting those challenges overwhelm me;)

Thanks for the thoughtful post. And congrats to your Pitt Panthers. They out-toughed my Clemson Tigers last week!

Thanks for the positive feedback. Frankl book is one of the best I’ve ever read. “Extreme Ownership” is a bit cliche but has some interesting concepts and worth a read. I originally heard Jocko Willink on Tim Ferriss podcast. If you haven’t heard his two episodes, I highly recommend both. Great stuff.

Totally agree about making a game of challenges. I’ve found that in my life I am drawn to challenges be it getting degrees, mountaineering, financial goals, etc. In retrospect, the goals and summits are not what is remembered, but the challenges along the way really are special.

Finally, Hail to Pitt!!! We usually end up on the opposite side of those games, so felt good to finally see the boys pull one out. Had some friends go down and they said Clemson people were great hosts, even post-game dishing out the southern hospitality. Definitely have to get back down there.

You are welcome anytime. Next time we can hike or bike parts of the 17,000 acre experimental forest surrounding the town. And I may even show you the stadium where the Panthers took us down:)

Happy thanksgiving!

Sounds like fun!

I don’t know that we’re yet in the place where we can figure out what the meaning is from recent world events, but it’s incredibly helpful to frame our thinking this way, instead of just letting it all get us down. Because even if health care goes away completely or gets much more expensive, we’ll still be fine, and that’s important to remember. The question is: how can we be a source of good in the world, and help out those who are less fortunate than us? (Because there are sure to be more of them now, even if the only change is ACA subsidies go away… that’s hard-hitting for 20 million people.)

Thanks, as always, for lending your thoughtful voice to this discussion! Always appreciate it. 🙂 Hope you guys have a great Thanksgiving!

Thanks. Happy Thanksgiving to you as well.