May Update//Revisiting Our Financial Independence Day

So Close!

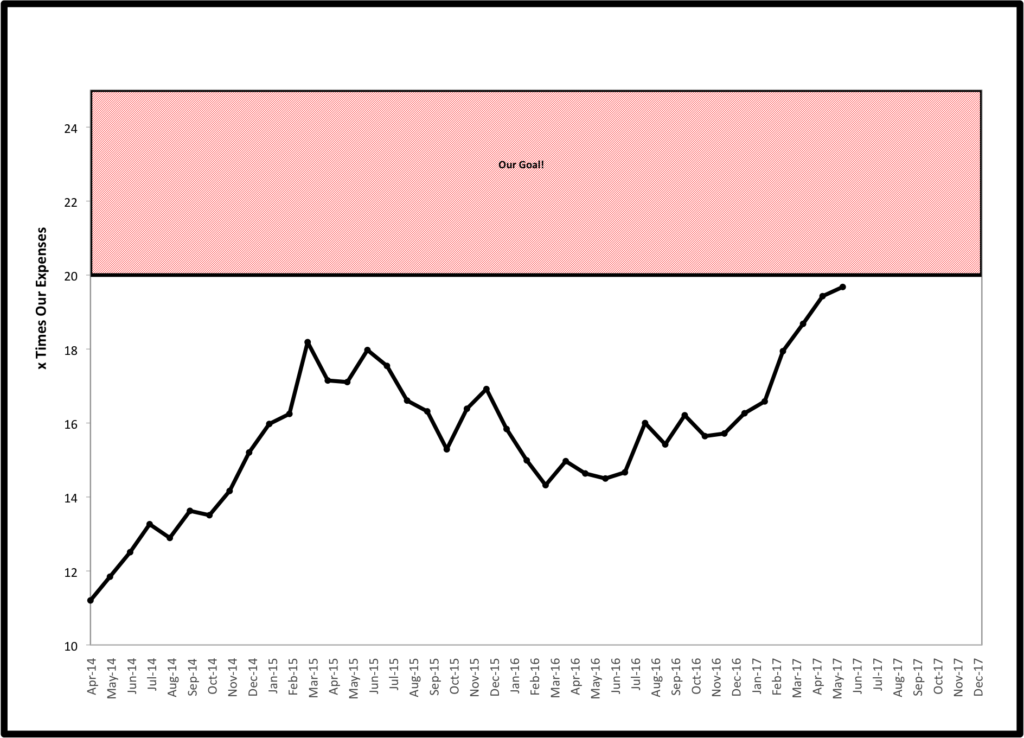

Our investments as a multiple of our annual spending number continues to creep up. We reached another all time high this month at 19.7X up from 19.4X last month. The asset side of the equation continues to be bolstered by the ongoing bull market and automated monthly contributions, pushing asset values up 1.7%.

On the spending side, we broke our trend of seeing our expenses steadily decreasing. Our annual spending was up .4% due to a few unusual expenses. The biggest was having to meet a deductible for Mrs. EE to have finger surgery. We also had to replace the brakes on one of our cars and spent some money on landscaping to give the house some curb appeal. On the fun side, we bought our annual pool pass.

Add it up and we spent more this May than last, keeping us just shy of our goal of achieving investments at least 20X our annual expenses by May of 2017 as was our goal when starting the blog.

Our Financial Independence Day

Two years ago I wrote the post “Our Financial Independence Day”, inspired by the idea of blogger Even Steven Money. Our FI Day, May 1, 2017, occurred in the past month. The date was pretty arbitrary. I had always had this idea in my head that I would retire by 40. My 41st birthday was this past month, thus I wanted to be done before then.

Over the past two years, we have changed our plans and thoughts on retirement quite a bit. As I shared earlier this year, we are now working towards our true goals. Despite not quite hitting our original financial goal, we are extremely close and comfortable with where we are financially. This past February I quit my job to start this next phase of our lives.

The Impact of Expectations

Over Memorial day weekend we spent a day hiking with new friends Jared and Whitney who write the travel physical therapy/ early retirement blog Fifth Wheel Physical Therapist. Jared and I discussed his intense path to FIRE, from 6-figure debt to FI in 5 years.

Something in our talk led me to ask him if the intensity that he was approaching his goal with was worth it, or if he should slow down just a little bit in order to enjoy life more now.

He still plans to stick with his original plan, but admitted the whole idea to be FI in 5 years was chosen because it “sounded kind of cool”. About two years in, he is on pace to meet or exceed that goal and he still wants to finish it. I’m not betting against him.

I have been reflecting on my own arbitrary goal to “retire by age 40” and Jared’s goal to “achieve FI in 5 years”. I can not help but realize the power of our own expectations.

On the flip side, the night before our hike we sat down to have dinner with a close friend. He is going through a very hard time in his career which is affecting all areas of his life. We were trying to encourage him to try something different to change things up. His response was basically “I’m sure that if I try something new I won’t like that either so why even bother trying”.

Unfortunately, negative expectations are equally if not more powerful than positive ones. We shifted the conversation to weather, sports, etc. knowing that we were going down a dead end street. It is impossible to help someone who is not yet ready for help.

What Is Realistic?

I think back to the first money/personal development book that I ever read, “Think and Grow Rich” by Napoleon Hill. My dad encouraged me to read it over one of my Christmas breaks in college, and I have developed the habit of re-reading it in January of each year. The book contains a quote that has stuck with me. “Whatever the mind can conceive and believe, it can achieve”.

More recently I read Tim Ferriss’ “Tools of Titans”. In it, he has a quote from his interview with Peter Theil that also stuck with me. “So if you’re planning to do something with your life, if you have a 10-year plan of how to get there, you should ask: Why can’t you do this in 6 months?” I do not take that quote literally to mean that faster is always better, but rather to use it as a prompt to question my assumptions.

I am not suggesting you can read an inspirational book, memorize a magic quote, listen to some guru, or pray that “God will provide” and expect magic to just happen. What I am suggesting is that the mind is incredibly powerful.

If you fill your brain with positive (or negative) thoughts and expectations you begin to accept them as truth. This belief and expectation causes implementation of daily habits and actions consistent with your beliefs. Your habits and actions will carry you to your anticipated destination.

Guard Your Expectations

As a big Tim Ferris fan, I listen to pretty much every one of his podcast episodes. One of the “Rapid Fire” questions that he asks almost all of his guests is “What advice would you give your X (20, 30, 40) year old self?”

When I started this blog, I used to think about what advice I would give a young person trying to figure out how to become financially independent and retire early. If you look at the first year of this blog, I was basically answering that question. I would teach people to do what we did right. Save 50% of your salary, avoid debt, etc. I would teach people to avoid our mistakes. Learn to invest, learn to understand the tax code, etc.

Thinking about where we find ourselves now, Mrs. EE and I are 39 and 41 years old and transitioning to our version of early retirement. Jared is right on pace, a couple of years into his 5 year FI plan. Our friend has no plan and little hope. We are all finding ourselves pretty much right where we expect to be.

Now I understand that I was missing the most important part. The best advice that I can give any young person is to guard your expectations as though your life depends on it. It literally does.

What do you think? Am I overstating the mental part of achieving FI (or any other goal)? Should people focus on the mental or technical side first? Is this all a chicken or egg argument? Chime in with your thoughts below.

*Thanks for reading. If you enjoyed this content, you can find my current writing at Can I Retire Yet?. Enter your email below to join our mailing list and be alerted when new content is published.

Top recommendations

There is an awesome message in this post. The most important advice is to have a plan and goals and base your daily decisions, both big and small, on working toward achieving them. Simple but very important. Whether or not I make it in 5 years isn’t a big deal as long as I’m making steady progress toward my goals because I’m confident that by starting with that goal in mind I’ll be in a very good financial position at that point regardless. I definitely know what you mean about your ideas regarding financial independence changing over the past couple of years and I’d be willing to bet that your plan will continue to evolve in the future, as will mine.

Agree completely Jared. I think that my “retire by 40” and your “FI in 5 years” are equally arbitrary and we would be hard headed if we were not learning and reconsidering what we wanted along the way. However, by starting with a goal that to most seems unattainable and maybe even absurd and truly believing it is possible, it has led us to take the necessary actions that are causing us to achieve outcomes far from ordinary, even if not what we originally imagined when starting.

Gogogogogogo! I’m also closing in on 20X. Retired at 40 just like you!

Awesome, except you had the courage and faith to take the plunge prior to reaching that plateau. Tip of the hat to you to deviate from the already different “standard” FIRE path of waiting until 25X to retire.

I think you have to focus on the mental side first, as evidenced by your friend. If you’re not mentally ready for something, then the technical part doesn’t matter because you’ll never start the technical aspect to begin with.

It took a while for me to accept that FIRE was possible, and then less than 3 years in we realized we didn’t necessarily want the early retirement side, as much as a lifestyle change from the life we created. Even now 3 years past that, my views of FIRE and our lifestyle change are a bit different.

Like how your plan changed thru time, I feel like most people focused on FIRE end up changing their views and attitudes towards it once they actually embrace working towards it and have it as a real goal.

I think it’s because it leads you to question “why am I doing this” and that leads down a rabbit hole of self discovery in things you may not have even thought were related.

I totally agree with your comment, particularly the part about self-discovery and questioning why in the hell we do most of the things that we do, what is actually possible from life and what we actually want.

Great post, EE. I like that you’re getting into the mental side of things. As a long-time athlete, I always found your lesson about expectations to be true.

One of my favorite books to read and reread is Wooden, by hall-of-fame basketball coach John Wooden. He recruited some amazing athletes while at UCLA, but from the beginning, he worked on their mind and their expectations.

I love that he focused on the PROCESS and EFFORT and CHARACTER as the primary goals. He truly believed the results (i.e. winning championships, early retirement, or whatever else you want to do) would come as a natural result of execution on those fundamentals.

I think we’re all in the same boat whatever goals we’re trying to reach. And our minds will either be wings or an anchor, depending upon how we structure it.

Thanks! I recently listened to a Tony Robbins interview with Wooden that was awesome. He talked a lot about process, down to the details of teaching his players how to lace/tie their shoes correctly. I have actually adopted one of Wooden’s techniques of writing down my core values which I carry with me and look at frequently to remind myself. I am adding his book to my reading list now.

The mantal part - willing to make a change to the traditional view on life - needs to come first. Then you can have a plan and act accordingly.

Our view on what we wanted shifted from being FIRE towards having a joyfull life now, even when that means a 5 year delay. It boils down to: why wait 10 years. Why can you not have it now? We discovered we were chasing the wrong thing.

Agree on both accounts. Why can you not have it now is a great question and is at the heart of questioning assumptions. I think even in the FIRE community who tend to pride ourselves on thinking differently than the masses that there is a herd mentality to follow a similar path and romanticize retirement as this time that will make all of our problems better. Why wait 10 years? Why not now?

I agree with the power of positive thinking when it comes to our finances. For example, I was given a tour of my neighbors’ house yesterday and saw what a nice home he had after 30+ years of work (he is in his mid-60s). I was thinking to myself that my house not could but will look nice as well one day. I’m willing to accept one day as a reality for now but it’s all about delayed gratification. I’m not willing to trade a nicely furnished house now for a much later retirement date when I know mentally that one day I will have both. It just becomes a matter of what I want to have first, financial independence or nice materialistic things.

Anthony,

I agree with the idea of rejecting either/or options that many people assume as truth. It is the basis behind everything that we believe as outlined in our “Dirtbag Millionaires” post.

http://eatthefinancialelephant.com/dirtbag-millionaires/

I’m certainly a little behind, but I did come to check out the FI Day! Looks like it has lead to bigger and better things, cheers!!

Indeed our plans have changed and evolved and continue to do so, but I think the idea of setting a FI day is a very powerful concept. As noted in the post, setting expectations, even if you’re not sure if they’re realistic or how you will reach them are incredibly powerful. Cheers to you for the idea!