Where Did All My Money Go?

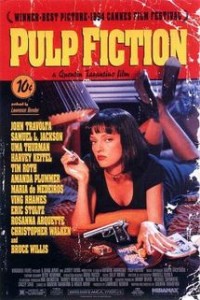

In one of my recent posts I went a little Quintin Tarantino on you.  I wrote about using the rule of 25 to figure out roughly how much money you need in your investment portfolio to be financially independent. You simply multiply your annual spending by 25 to calculate your financial independence number. However, this is giving you the end of the story before understanding the beginning. First, you MUST know how much money you currently spend annually. Simply knowing where your money is going may also give you some unexpected benefits.

I wrote about using the rule of 25 to figure out roughly how much money you need in your investment portfolio to be financially independent. You simply multiply your annual spending by 25 to calculate your financial independence number. However, this is giving you the end of the story before understanding the beginning. First, you MUST know how much money you currently spend annually. Simply knowing where your money is going may also give you some unexpected benefits.

Now that we know the concept of the rule of 25, the need to know our annual spending seems pretty obvious. However, we went through most of our adult lives not having any real idea what our monthly or annual expenses were. We only started tracking our expenses this past fall. In talking to others about our early retirement plans, we explain this concept often. To this point, we haven’t met anyone who knows the answer to the question: “How much do you spend in a year?”

We have always had about a 50% savings rate because we stumbled upon our system. Our method of budgeting has been this. My wife started to work a professional job when I was in grad school. Her new professional salary (about $35,000) was more than we ever made combined, making us feel pretty rich. We could use this salary to pay for all of our expenses. I would put any money I had from my crappy part-time jobs and paid internships toward her loans. We were able to pay off her car in just a few months and made a big dent in her school loans, with just my very small income. Within my first year of working a professional job, we continued this system and were able to pay off all debt. Since this method worked so well for paying off debt, we decided to continue living on her salary while allowing our spending to increase with her income. We continued using my also increasing salary to pay off our home quickly and build investments. Doing this, we maintained our savings rate between 40-60% depending on how we were individually advancing in our careers.

We basically paid no attention whatsoever to how we were actually spending or investing our money. I just took my salary, blindly threw some money at our mortgage and handed the rest over to a financial advisor. She took her salary, paid whatever bills we had and we spent the rest without thinking much about it at all. This worked out pretty well for building a large net worth quickly compared to our peers. We were left feeling pretty good. It also left for large levels of inefficiency.

This past fall when we first learned of this rule of 25, we decided we needed to track our expenses to figure out how much we would need to retire. At first, the process seemed daunting for 2 people who never had more than a very loose budget. We’ve found it is actually quite simple. We sat down and started listing all of the bills and expenses that we paid each month and put them into an Excel spreadsheet. (You may prefer a site like mint.com that is set up for this.) As things came in that were not regular expenses, such as insurance premiums or season ski passes, we simply added a line to the spreadsheet. We do almost all of our spending through online bill pay and using a cash back credit card that we pay off in full each month. This makes having all of this information handy when entering it. We simply pay our bills and balance our checking accounts once a month and then transfer the numbers to the spreadsheet.

Our goal was simply to spend a few minutes each month and get a running total of our spending and then total it up to get our annual spending. We wanted to know how much it costs to live our current, satisfying lifestyle. We weren’t concerned with decreasing our spending. I’ve already shown you how we’ve wasted almost $8,000 just last year on investment advice and fees. With a savings rate of over 50% there couldn’t still be much left in our spending to improve on right? WRONG! Just by seeing these numbers laid out in one place, we were able to find huge inefficiencies in our spending. This is money that was giving us no increased quality of life and was just trickling out of our accounts each month. Here are a couple of examples.

We were spending about $75/month on cell phone service thinking we were being frugal by avoiding smart phones and data plans. Then we started reading about people spending less than half of what we were while having superior phones and service.

Next were our oversized energy bills. I was never a big believer in man-made global warming before tracking our expenses. Now I not only believe it, I think I may be the man causing it! We have electric bills over $100/month, year round. Seeing that number caused us to actually look at our bill instead of just paying it and moving on. It is over 20% higher than our average neighbors use. Our ridiculously inefficient driving habits have us spending close to $400/month just in gas for our cars, despite Mrs E.E. working from home. An investigation of how we are spending this much is under way. Can we decrease our spending, have less impact on the planet and improve our quality of life at the same time just by improving efficiency?

We realized that we haven’t evaluated our insurance needs and coverage for years. How much of this coverage are we overpaying for? Could we actually better protect ourselves, while paying less, using higher deductible plans we can now afford? How much can we eliminate completely?

The list can go on. I’m talking about saving money WHILE improving the quality of services that are obtained by simply paying attention to what you’re paying. I plan to write a follow-up post in about a year, but my goal is to cut our “frugal” spending by $500/month just by eliminating waste. Can it be done? We’ll see. What can you find in your budget that is just money flowing down the drain every month?

I would recommend that everyone have some method of either budgeting or tracking where and how your money is being spent. At the very least, you will have a starting point to begin your financial planning. I’ll be very willing to bet that as you start writing your numbers down and realizing how your money is spent, you will also have benefits far beyond your original expectations.

*Thanks for reading. If you enjoyed this content, you can find my current writing at Can I Retire Yet?. Enter your email below to join our mailing list and be alerted when new content is published.

3 comments on Where Did All My Money Go?

Comments are closed.