Will We Make It?

Can we do it? Let’s find out together!

We are tracking our progress toward our goal of early retirement by May 2017. Follow along and see how we do!

Update

Since we originally started on our journey, our plans and goals have changed considerably. For starters, Mrs EE has found a dream job that is location independent and allows her to work part-time while providing healthcare for our family and paying her enough to fully fund our current lifestyle. This has given me the ability to confidently and comfortably quit my job prior to hitting our goal. For full disclosure, we are no longer pursuing anything that looks like traditional retirement.

Also, as we have thought long and hard about our long-term plans and desires we have realized that early-retirement is not our ultimate goal. Early retirement is merely one means to the ends of living a life in alignment with our long-term goals and values of faith, family, health, community, and adventure. Therefore, since originally publishing this page, we have developed our ultra-safe early early retirement plan.

We do continue to publish our monthly progress and will continue to do so for the foreseeable future. These monthly updates have become some of our most popular posts (and frankly in some months our only published posts) as many people have connected to our story. Also, we hope to show that this is a more balanced, healthy, and prosperous way of life than sacrificing physical, mental, and emotional health to simply reach a number to retire to a life filled with new stress of transitioning from living with abundance mindset while having a high savings rate to living a lifestyle of stress where you worry each time markets drop or expenses increase.

The remainder of the page remains as originally published in an effort to show how we have progressed and at times struggled on our journey to FI. We hope you enjoy and find it useful on your own journey!

///////////////////////////////////////////////////////////

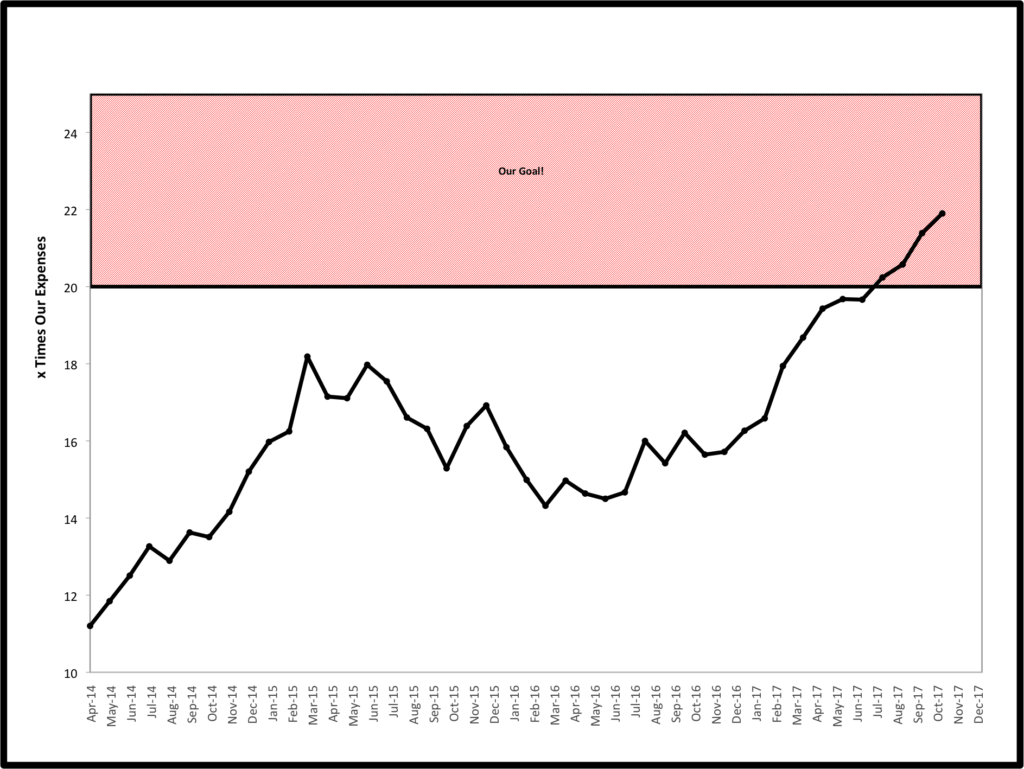

The general formula for financial independence is to have 25 times your annual expenses, allowing for a 4% withdrawal rate in retirement that should allow your money to last indefinitely while gradually increasing spending to adjust for inflation. This is a model that essentially involves playing a game of chicken to see if your money runs out. Our strategies are more flexible and incorporate risk management so we will use these numbers as guidelines only. Our detailed strategies and plans will be outlined in the blog.

Our goal is to track our expenses and our investments and continue to work until we are able to accumulate 20-25X our annual expenses. Any time we are able to find a way to achieve a saving that decrease spending that we will be able to sustain, add money to our investments, have market gains, or receive interest or dividends we will move closer to our goal. Any time our spending increases or our investments lose money, we would move further away. Since there are a lot of moving parts, we are not worried about a specific dollar amount and so we will express our goal in terms of multiples of our annual spending.

We have quite a way to go in terms of savings by May 2017. We’ll update our progress each month so that everyone can see how we are doing and whether or not we’ll achieve this goal. So, check back each month to see where we are on the journey to early retirement!

November 2017: Our number keeps rising, which is great as we take our leap into early retirement at the end of this month. Read the October update to hear more on the upcoming change.

August-September 2017: Our numbers are looking better and better! We hit our goal mark of being 20X our expenses at the end of July - exciting! We remain there, and actually improved slightly by the end of August. We know that we have to remain realistic though - the markets are not going to keep going up at this pace forever. Read the July Update post to see what we are thinking.

June-July 2017: The markets continued to do good for us in May even though our spending increased a little. We reached our all time high of 19.7 times our expenses. The May Update post looks at these numbers in relation to our Financial Independence Day that we set a few years ago. Although we had a high spending month for June, our average expenses did not increase too much, and our assets still increased keeping our X times expenses value nearly the same at 19.6. Check out the June update to read about the big surprise purchase.

March 2017: What a great month! We are at our all time high on our assets as a multiple of our average annual expenses. We hit 18.7x. Read the March update post to see how we had such a big jump this month.

February 2017: We missed our January update, but as you can see from the chart, it was a good month. That said, February was a great month! We cut our expenses, and our assets did really well. Look at that nice increase to 17.9x times Expenses! Read more about it here. This was nice to see now that Mr. EE has officially told his boss his plan to retire this year.

December 2016: We had a great month. Investments performed really well. December was an expensive month though, but all good stuff and still slightly less than last December, making the 12 month average expense slightly decrease. We are over 16x our spending, but not quite where we were last year at this time. But that’s ok - we’re happy! Read here for more.

November 2016: Not too much change from last month. Our assets did fairly well, but our average spending is up slightly. See this month’s update for details.

October 2016: We were doing great with spending this month and then had some big expenses toward the end. Our graph is going down again after last month’s high. Read about October here.

August-September 2016: After a slight dip in August, we hit our highest month for 2016 in September. This is actually the best since November of last year.

May-July 2016: After a few down months, things are looking up again! Read the updates here: June; July.

April 2016: Returns were not too great this month, and we saw another increase in our spending. This led to another drop in our graph above. But at least it wasn’t a big drop! Read the full update here.

March 2016: Finally, the line is heading in the right direction! We had a good return this month, but spending was up. Read about it here.

February 2016: The downward trend continues for February.

January 2016: We did not end 2015 on a good note for reaching our goal, and the start of 2016 is even worse!

December 2015: We took a hit this month. Not the best way to end the year, but we look forward to the new year!

November 2015: We are creeping up…slowly but surely.

October 2015: Nice little spike this month!

September 2015: Still heading downward…here’s the update.

August 2015: Ouch - down again!

July 2015: Down this month! Read about it here.

June 2015: Heading in the right direction! Read this month’s update here.

May 2015: We will start making these monthly updates as separate posts. See May Update to see how we did.

April 2015:

We decided to change the way we track our progress. We were using a steady annual expense figure (the amount we anticipate to be our annual expenses at early retirement). But, we think we should be tracking our actual expenses in comparison to our investments. So, the expenses used for each month is now our actual twelve month average. This changes the way our graph and progress look. Unfortunately, March was an EXPENSIVE month for us with home repairs, tax payments, and some home improvement projects. Although we saw an increase of 1.7% in our investments, we went downhill this month because the expenses were too much. We’ll make sure we get back on track next month though!

This month’s tip: This follows from previous tips…it is the end of the winter and ski season. Take advantage of those clearances and deals. We just got our ski passes for next year and saved more than 50% by doing so this early. We also checked out the clearance ski gear for our little skier because we know she’ll be out with us a lot more next year.

March 2015:

February 2015:

Same report as last month…up about 1.6% this month. No change in expenses this month. However, we did roll over Mrs. EE’s 403b from her prior employer to our Vanguard investments and sold off 2 more of our old managed mutual funds that we bought when using an advisor (only 1 left). That will save us lots of money over time by cutting our investment expense on both fronts and decreasing the annual taxes on the managed accounts.

This month’s tip: Consider cutting back your cable. Not only has this saved us $35 a month, but it has given us so much more time! You do not realize how much wasted time you spend in front of the tv until you cut it out. We still have basic cable (because we need high speed internet for Mrs. EE’s work from home job, and it is actually cheaper that way.) Without the expanded cable, we watch very little tv now. That has led to much more productive time and excellent quality time with our daughter.

January 2015:

Slow and steady on the gains, up about 1.6% since last month. Meanwhile expenses were slightly lower than usual despite the holidays.

This month’s tip: Don’t make New Year’s resolutions. Most people take the new year and set a bunch of resolutions that they then forget about in months, weeks or even days. This year, pick one or two things that you want to do and automate them so you don’t have the option to not do them. For us, our first financial goal is to max out tax advantaged savings. That means setting up with our employers to withhold from our paychecks and setting up a separate automatic deposit into our Roth IRA’s. This takes no more than 10 minutes to find the 2015 limits for these accounts, take the appropriate actions and then never think about it again until 2016. Goal accomplished!

What are your biggest goals for 2015 and how can you automate making them happen? Got ’em? Good, now get it done!

December 2014:

We’re up 10% from last month!! Well, not really. We weren’t counting our cash (bank savings) in our totals and realized it should be tallied in. It’s saved money to use later - why shouldn’t it be counted?! But, with that aside, we did have a 3% increase since last month, which is great.

This month’s tip: It’s ski season! We saved $500 between the 2 of us by opting for a weekday pass versus a full season pass. Saved us money and LOTS of time wasted waiting in lines. Weekend lines are terrible, but there are no lines on weekdays. That means much more skiing on ski days! Oh, and to make it better, we got the early bird special saving us even a couple hundred more!

November 2014:

Here we are as of November 1, 2014. It looks like a long ways to go…yikes!

Tip: Pack a lunch everyday instead of eating out at work. Save $5-$10 per day ($1,300 - $2,600 per year). May not seem like much, but invest that each year over the next 25 years, you could be $102K-$205K wealthier!

Top recommendations

Excited to follow along! May 2017 is just down the road, 2 years and you will be “dirty millionaires”!

Working our way through your site — it’s great to see this progress. You’re doing so well! Though certainly, like us, you’re wondering if these market gains can hold out indefinitely. We’re skiers, too, and love that you all plan and budget for that. That is one of our non-negotiables in early retirement: always being able to ski. Though once we’re not working weekdays anymore, we can buy the much cheaper restricted passes.

Nice way to track your numbers 🙂

It won’t work for me since I plan to drastically change spending habits (for example, leaving the HCOL country I live in right now)

Anyway I have a question: why is your goal 20x? People are trying to be more conservative and don’t trust the 4% rule… is there a rationale behind your 5% rule?

A couple of reasons. First off, we want to have at least 20X our current spending to put us in the ballpark of FI and would prefer to have at least 25X. However, with our investments primarily in volatile paper assets we are not tied to that and are more committed to changing our lifestyle ASAP while our daughter is young and we are both still in excellent health. Second,our plan is to continue to continue to make some money as needed as we are not very interested in a traditional retirement, as much as a drastic lifestyle change allowing more time for parenting and pursuing outdoor adventures and not being tied to traditional 40+ hour workweeks. Finally, we also anticipate that we will decrease our spending in retirement in part by relocating to an area that has the amenities that we desire which will decrease our current travel spending. We also plan to downsize our home which will lower regular expenses. Good questions. Thanks for taking the time to comment and I hope you’ll continue reading along.

Cheers!

EE